761624.ru Community

Community

What Are The Futures Doing Right Now

Get Live Dow Futures Rates. Dow Jones Futures Live & updated. Other Stock Market Futures Live. Chart of Dow Jones Industrial Average Index. Then, when you do start trading with real dollars, trade small to start, and work your way up. Build a well-defined futures trading plan including clear. Futures News · U.S. oil benchmark bounces off month low on potential hurricane threat · Oil prices drop 8% for the week, pressured by prospects of a slowdown. @Futuresfins. Follow us on the social waves to stay current with our team, get behind the scene looks at the product in development, chances to win new. I do agree that all this finance stuff is often arcanely For me right now it's the E-Mini Micro. Brokers. You'll need a broker. Barron's , , ; CBOE Volatility, , ; DJIA Futures, , ; S&P Futures, , Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. Futures Market Trading Hours ; Micro Ultra Year U.S. Treasury Note. MTN. MTNA ; 3-Year U.S. Treasury Note, Z3N, Z3N ; U.S. Treasury Bond, ZB, USA ; Micro Year. Explore our comprehensive stock futures table showcasing real-time, streaming rates of the global futures market today including US stock futures. Get Live Dow Futures Rates. Dow Jones Futures Live & updated. Other Stock Market Futures Live. Chart of Dow Jones Industrial Average Index. Then, when you do start trading with real dollars, trade small to start, and work your way up. Build a well-defined futures trading plan including clear. Futures News · U.S. oil benchmark bounces off month low on potential hurricane threat · Oil prices drop 8% for the week, pressured by prospects of a slowdown. @Futuresfins. Follow us on the social waves to stay current with our team, get behind the scene looks at the product in development, chances to win new. I do agree that all this finance stuff is often arcanely For me right now it's the E-Mini Micro. Brokers. You'll need a broker. Barron's , , ; CBOE Volatility, , ; DJIA Futures, , ; S&P Futures, , Get the latest data from stocks futures of major world indexes. Find updated quotes on top stock market index futures. Futures Market Trading Hours ; Micro Ultra Year U.S. Treasury Note. MTN. MTNA ; 3-Year U.S. Treasury Note, Z3N, Z3N ; U.S. Treasury Bond, ZB, USA ; Micro Year. Explore our comprehensive stock futures table showcasing real-time, streaming rates of the global futures market today including US stock futures.

Futures. Symbol. Price. Market Time. Change. Change %. Volume. Open Interest Weʼre unable to load stories right now. Copyright © Yahoo. All rights. What are futures and how do you trade them? Spot trading · How to trade spot Calculated to the nearest 1%. Start trading now · FAST · SECURE · RELIABLE. Where to catch 9 Futures Game standouts RIGHT NOW! Last week, a few days Do not Sell or Share My Personal Data; Cookies Settings. © MLB Advanced. do business or where such products and other services offered by the tastytrade would be contrary to the securities regulations, futures regulations or. The latest commodity trading prices for Index Futures: Dow, S&P, Nasdaq and more on the U.S. commodities & futures market. Futures Exchange in (now Euronext. liffe), Deutsche Terminbörse (now right to the futures position specified in the option. The price of an. United States Stock Market IndexQuote - Chart - Historical Data - News. Summary; Stats; Forecast; Alerts. US stock futures Investors now look forward to key. You don't have to trade futures to understand what the markets are doing globally. critical Sorry, we can't update your subscriptions right now. Please try. Looks like there's nothing to report right now. Reload · Technicals. Summarizing A representation of what an asset is worth today and what the market thinks. Do Not Sell or Share My Personal Information · Complaints Because we respect your right to privacy, you can choose not to allow some types of cookies. Dow Jones Futures - Sep 24 ; Prev. Close: 40, ; Open: 40, ; Day's Range: 40,, ; 52 wk Range: 32,, ; 1-Year Change: %. Get the latest global futures market data and news from Nasdaq. E-mini S&P futures have made futures trading more accessible to traders and they are the most commonly traded U.S. stock index future offered at the CME. In. Crypto Crackdown Puts Binance-Linked Stablecoin in Crosshairs. The Booming Crypto Use Case That's Happening Right Now · Paris Blockchain Week Summit Day Two. They can be found under the Futures tab as well as the Trade tab in the Futures Trader section. All you need to do is enter the futures symbol to view it. More Futures for Dow Jones ; YMT SEP24, 9/6/, , ; YM SEP24, 9/6/, 40,, Get the latest Lumber price (LBR) as well as the latest futures prices and other commodity market news at Nasdaq Investing. Where are the Pandemic Winners Now. DOW FUTURES is based on future contracts of DOW index. It is traded on the Chicago Board of Trade (CBOT). DOW is a price-weighted index that includes NIO Stock Caught an Upgrade. Shares Rose. Tesla Stock Got Hammered at the End of a Very Good Week. 3 Reasons for Friday's Fall. The Final Hour of Trading. Futures Market Map ; Metals. +% ; Energies. +% ; Indices. +% ; Currencies. +% ; Grains. %.

Can Turbo Tax Find My W2

An employer cannot send a W-2 to TurboTax without your authorization. According to the IRS, employers must obtain your consent before they can. It is possible to use W-2 forms as a reference for filling out the input fields. Relevant W-2 boxes are displayed to the side if they can be taken from the form. TurboTax does not have a copy of your W-2—the Wage & Tax Statement—issued to you by your employer, (nor does TurboTax have copies of your 's). You should. Question? I need my w-2 for disability, but I can't find it and I filed with TurboTax. If you can still view "all forms" on their website. File previous year tax returns on FreeTaxUSA. Online software uses IRS and state tax rates and forms. tax deductions and write-offs are included. Can you find a W-2 from a previous year on TurboTax? No, TurboTax does not keep copies of your old W-2 forms issued by your employer. However, if you saved a. by TurboTax• Updated 1 month ago · If your W-2 can be imported, you'll come to the Great news! We can automatically import your W-2 info screen. · If TurboTax. You can access most USAA tax documents online. Go to My Documents. Schwab. Get tax. Not directly, but they can import your W2 into their tax return software if you have the necessary authentification data. An employer cannot send a W-2 to TurboTax without your authorization. According to the IRS, employers must obtain your consent before they can. It is possible to use W-2 forms as a reference for filling out the input fields. Relevant W-2 boxes are displayed to the side if they can be taken from the form. TurboTax does not have a copy of your W-2—the Wage & Tax Statement—issued to you by your employer, (nor does TurboTax have copies of your 's). You should. Question? I need my w-2 for disability, but I can't find it and I filed with TurboTax. If you can still view "all forms" on their website. File previous year tax returns on FreeTaxUSA. Online software uses IRS and state tax rates and forms. tax deductions and write-offs are included. Can you find a W-2 from a previous year on TurboTax? No, TurboTax does not keep copies of your old W-2 forms issued by your employer. However, if you saved a. by TurboTax• Updated 1 month ago · If your W-2 can be imported, you'll come to the Great news! We can automatically import your W-2 info screen. · If TurboTax. You can access most USAA tax documents online. Go to My Documents. Schwab. Get tax. Not directly, but they can import your W2 into their tax return software if you have the necessary authentification data.

If you cannot get a copy of your W-2 or , you can still file taxes by filling out Form , “Substitute for Form W-2, Wage and Tax Statement.” This form. You can easily upload your tax documents from last tax season. Get Find my W-2 online · Refund & payment options · Tax payment center · Where's my. Why does my W2 show no wages in {box 1} or State Wages in {box 16}? If you Unfortunately, we cannot provide any tax advice, please contact the IRS or your tax. Please obtain your self-service registration code from your company Payroll or HR department. Once you have your registration code, you can register at login. You have the option to import your W-2s into TurboTax. This feature is quick, easy, and automatically puts your information in the right places on your tax. File My Income Tax Return. Register for an OH|Tax Account to electronically OHID is a single username and password that allows you to securely access multiple. Most people can file in minutes with our step-by-step instructions. You can even snap a photo of your W-2 to add it automatically. Accurate calculations. I am a longtime user of turbotax, first via downloaded software and now the mobile app which I enjoy using. I know you will consider my feedback and I look. See when all of your tax forms will be available. Year-end distributions by Fidelity mutual funds. Get year-end distributions by Fidelity mutual funds you. TurboTax will review your work and flag any errors or missed opportunities before you file. Know that your taxes are done right with our % accurate. You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting. You either call your employer (HR or Payroll Department) and ask for a copy. · Usually, as an employee, you are given access to your company's. Get the online tax preparation services you need with the tax refund you want. Whether you efile or work with an H&R Block tax pro, our services are. We support free W-2 uploads, so you can autofill your information fast. Get access to your tax forms: W-2 and C. Employer Name/Code. Remember my See resources that will help make completing your income tax returns a little. Question? I need my w-2 for disability, but I can't find it and I filed with TurboTax. If you can still view "all forms" on their website. TaxSlayer helps you easily file your federal and state taxes online. Learn about our tax preparation services and get started for free today! Use our free tax calculator to quickly estimate whether you'll get a refund or owe the IRS. See how income, deductions, and more impact your tax. In the Federal Taxes section of TurboTax, you will be prompted to enter the Employer Identification Number (EIN) from your W-2 (usually in Box B). If the EIN. E-file your federal and state taxes online with TaxAct. Explore tax products for a wide range of tax filing situations and get your maximum tax refund.

Is Asus A Good Gaming Computer

Asus offers gaming desktops, here have a look: 761624.ru a great gaming pc can be from $ and upwards depending how demanding. Our most premium gaming laptop, made superior, now with the elevated performance of Intel® Core™ Ultra processors. CUSTOMIZE. A woman, only her mid-section in. Designed inside and out for superior gameplay with top notch cooling, this compact Windows 10 Pro gaming desktop uses up to an NVIDIA® GeForce RTX™ Absolutely, ASUS hardware is good for gaming. ASUS has two brands, Republic of Gamers and TUF Gaming, which are dedicated to facilitating exceptional. Everything you need to level up your game · Best-in-class graphics and display. Experience high-performance gaming with stunning visuals, ultra-low latency, and. A gaming PC is a specialized computer designed to handle resource-intensive tasks associated with playing video games. Unlike standard computers, gaming PCs are. This computer is awesome. We use it all the time. It has great colors for the gamer and ease of setup and use for the rest of the family. The new Asus ROG Ally, officially shipping June 13th for $, is a handheld gaming PC like the Steam Deck. But while the hardware sometimes impresses. ASUS makes the best hardware for PC gaming, eSports, and overclocking. Our innovations deliver top performance and premium experiences for everyone. Asus offers gaming desktops, here have a look: 761624.ru a great gaming pc can be from $ and upwards depending how demanding. Our most premium gaming laptop, made superior, now with the elevated performance of Intel® Core™ Ultra processors. CUSTOMIZE. A woman, only her mid-section in. Designed inside and out for superior gameplay with top notch cooling, this compact Windows 10 Pro gaming desktop uses up to an NVIDIA® GeForce RTX™ Absolutely, ASUS hardware is good for gaming. ASUS has two brands, Republic of Gamers and TUF Gaming, which are dedicated to facilitating exceptional. Everything you need to level up your game · Best-in-class graphics and display. Experience high-performance gaming with stunning visuals, ultra-low latency, and. A gaming PC is a specialized computer designed to handle resource-intensive tasks associated with playing video games. Unlike standard computers, gaming PCs are. This computer is awesome. We use it all the time. It has great colors for the gamer and ease of setup and use for the rest of the family. The new Asus ROG Ally, officially shipping June 13th for $, is a handheld gaming PC like the Steam Deck. But while the hardware sometimes impresses. ASUS makes the best hardware for PC gaming, eSports, and overclocking. Our innovations deliver top performance and premium experiences for everyone.

For me, I have had 2 ASUS UX Laptops, and they worked flawless for me for years without any issues for gaming. I am using the RoG Phone, and their quality is. The Asus ROG GA15 is a superb gaming PC that comes in so many stellar configurations. For content creators, this is a great option thanks to plenty of storage. Shop for ASUS Gaming Desktops in Gaming Desktops & Laptops. Buy products ASUS ROG Strix GA15DKDS Desktop Computer - Ryzen 7 X GHz - 16GB. A good gaming computer can handle modern AAA game demands without performance issues such as lagging or freezing. Several factors contribute to this matter. The Asus Republic of Gamers G20 is a small-form-factor gaming PC with enthusiast-level components and good gaming performance at a moderate price. However. PC gaming ASUS refers to desktop or laptop computers for playing video games. Asus is a popular brand that manufactures gaming computers. There are different. ROG OLED Anti-Flicker Technology One concern OLED gaming displays generate is flicker that occurs when VRR is enabled, due to the way OLED. Absolutely, ASUS hardware is good for gaming. ASUS has two brands, Republic of Gamers and TUF Gaming, which are dedicated to facilitating exceptional. While it might not pack the same high-end features found in more expensive Asus models, it still offers good performance and quality graphics, which is a. ROG makes the best hardware for PC gaming, eSports, and overclocking. Our innovations deliver top performance and premium experiences for everyone. Elevate your everyday gaming experience with powerful ROG Strix series' gaming desktops designed for every budget. These battle-ready desktops are equipped. The new Asus ROG Ally, officially shipping June 13th for $, is a handheld gaming PC like the Steam Deck. But while the hardware sometimes impresses. It absolutely is! Not only that, it's one of the best and most original brands out there! ASUS products are not only built well, but they also perform at. Custom PCs with World-class Hardware Powered by ASUS is a global program across more than 40 countries and involves over partners who provide the very. Shop for ASUS Gaming Desktops in Gaming Desktops & Laptops. Buy products such as ASUS ROG Strix Gaming Desktop, AMD Ryzen 5 X, GeForce RTX Ti DUAL. ROG Strix G15CE Gaming Desktop Computer, Intel Core iF, 16GB DDR4, GB SSD, 1TB HDD, NVIDIA GeForce RTX , Windows 10 Home Only 5 left in stock -. Asus Retro Gaming PC Windows Vista Pentium D gb SSD Radeon GPU Computer ; Graphics Processing Type. Dedicated Graphics ; Accurate description. ; Reasonable. Get it now! Unlock the Windows 11 Home gaming experience with the ROG Strix G13CH. Powered by a 13th Gen Intel Core iF processor and an NVIDIA. Windows 11 Home · Intel® Core™ iKF CPU · ASUS Z GAMING WiFi 7 · 64GB DDRMHz KINGSTON RAM · GeForce RTX Ti SUPER - 16GB · 2TB WD M.2 NVMe SSD. Asus is a global manufacturer of consumer electronics and computer hardware. One of the world's leading manufacturers of motherboards, ASUS also makes gaming-.

Best Credit Card For Healthcare Expenses

Healthcare credit cards can help with hefty medical bills. A close look at CareCredit, the largest provider of such cards, shows some possible perils. When you use your covered Visa Signature® card to purchase travel tickets, you can be reimbursed for emergency medical or dental expenses you incur when. The CareCredit credit card can help pay for health, wellness, and medical costs with special financing options. Learn how it works and apply today! Take control of your spending with Brex's business credit cards, automated bill pay, and spend management tools. Make your money work as hard as you do. CareCredit is one of the most popular dental credit cards, known for its wide acceptance among healthcare providers. It offers no-interest financing if paid in. Health Reimbursement Accounts (HRAs), Health Savings Accounts (HSAs), and Flexible Spending Accounts (FSAs) can be great cost-savings tools. Fee for credit. A low-interest credit card you may want to consider is the no-annual-fee Platinum Mastercard® from First Tech Federal Credit Union, which provides cardholders. Employees can use their HSA, FSA or HRA cards to pay for qualified medical expenses wherever Visa Debit cards are accepted. best for your company and your. Which Credit Cards are Best for Hospital & Medical Bills? · American Express True Cashback Card · UOB One Card · HSBC Advance Credit Card · Standard Chartered. Healthcare credit cards can help with hefty medical bills. A close look at CareCredit, the largest provider of such cards, shows some possible perils. When you use your covered Visa Signature® card to purchase travel tickets, you can be reimbursed for emergency medical or dental expenses you incur when. The CareCredit credit card can help pay for health, wellness, and medical costs with special financing options. Learn how it works and apply today! Take control of your spending with Brex's business credit cards, automated bill pay, and spend management tools. Make your money work as hard as you do. CareCredit is one of the most popular dental credit cards, known for its wide acceptance among healthcare providers. It offers no-interest financing if paid in. Health Reimbursement Accounts (HRAs), Health Savings Accounts (HSAs), and Flexible Spending Accounts (FSAs) can be great cost-savings tools. Fee for credit. A low-interest credit card you may want to consider is the no-annual-fee Platinum Mastercard® from First Tech Federal Credit Union, which provides cardholders. Employees can use their HSA, FSA or HRA cards to pay for qualified medical expenses wherever Visa Debit cards are accepted. best for your company and your. Which Credit Cards are Best for Hospital & Medical Bills? · American Express True Cashback Card · UOB One Card · HSBC Advance Credit Card · Standard Chartered.

best program for an individual before applying a Share of Cost. Who has a Can I use medical bills that I charged to my credit card? A. Yes, however. Susan G. Komen Customized Cash Rewards credit card. Help fight breast cancer and get a $ online cash rewards bonus offer. No annual fee †. Good financial habits help build a brighter future. Plus, earn up to 3% cash back on gas and EV charging and 2% on utilities and groceries (with a combined. Estimate your healthcare expenses. Get essential information on costs Kiplinger's Personal Finance Best List for Best Health Care Cost Estimator. Best credit cards for medical bills · AARP® Essential Rewards Mastercard®* · Chase Freedom Unlimited · Citi Custom Cash® Card*. World Elite Mastercard®. Outstanding purchasing power and top-of-the-line features and benefits Medical Claim Auditor: Organizes, tracks and audits all. That's why we've created a specialized healthcare credit card designed to ease the financial burden of medical bills, even with health insurance, and ensure you. Employees can use their HSA, FSA or HRA cards to pay for qualified medical expenses wherever Visa Debit cards are accepted. best for your company and your. Applying for our a card is easy! Advanced Care is committed to bringing you the best credit card offers. Apply Now. At Rectangle Health, we offer healthcare technology like our patient financing solution, to help healthcare providers better manage patient financing. CNPL is a. Which Credit Cards are Best for Hospital & Medical Bills? · American Express True Cashback Card · UOB One Card · HSBC Advance Credit Card · Standard Chartered. The Paytient card is not a loan or another Buy Now Pay Later option. It's a sponsored, interest-free line of credit that we call a Health Payment Account (HPA). The Paytient card is not a loan or another Buy Now Pay Later option. It's a sponsored, interest-free line of credit that we call a Health Payment Account (HPA). Banks, credit unions, and other financial institutions offer HSAs. Get a list of qualifying medical and dental expenses in 761624.ru Publication (PDF). Use your credit card again and again for the care you need for yourself and your family. Browse Health & Wellness brands. Sam's Club. 2 offers available. Our lowest rates are available to consumers with the best credit. Many credit card. If your application is approved, we will send funds after you. With an Alphaeon Credit card, you'll find a wide array of monthly payment options to help you be your best you. With special financing options** for any. Credit cards are convenient, but responsibility is key. Learn how to use your credit card responsibly and avoid common spending problems with these tips. Our lowest rates are available to consumers with the best credit. Many credit card. If your application is approved, we will send funds after you. CareCredit™ could make sense if you'll need money on a continual basis. CareCredit™ is a credit card specifically for medical, dental and vet expenses. It comes.

How To Use Coinbase Card

Sign in to your 761624.ru account or access the Coinbase mobile app. · Select Card from the navigation bar. · Follow the prompts to apply for your Coinbase. Coinbase Card charges a spending fee in two parts. First, you have the straightforward card commission. This commission is % for "domestic purchases". This. You buy usdc or euros on coinbase via ach. Then, use your card everywhere as credit or debit. You set up the pin number in coinbase. You earn 1%. The new Coinbase Card makes cryptocurrencies within a Coinbase account as easy to spend as traditional money by instantly exchanging the cryptocurrency for GBP. Your Coinbase balance can be used to fund a Visa debit card. This is the easiest and fastest way to spend crypto around the world. Your Coinbase account balance. The Coinbase Card enables you to make purchases with crypto online and in-store — anywhere Visa is accepted. The Coinbase Card offers rotating spending rewards. Use: Immediate use, activate, PIN setup, spending limits and restrictions. Manage: Request a new card and update billing info, name, PIN and funding balance. You can add a debit/credit card and/or bank account to your 761624.ru account as a payment method. Using a debit/credit card to buy cryptocurrency (crypto). 1. Link your Coinbase account to your Coinbase card. This can be done easily in the Coinbase app. · 2. Load funds onto your card. You can do. Sign in to your 761624.ru account or access the Coinbase mobile app. · Select Card from the navigation bar. · Follow the prompts to apply for your Coinbase. Coinbase Card charges a spending fee in two parts. First, you have the straightforward card commission. This commission is % for "domestic purchases". This. You buy usdc or euros on coinbase via ach. Then, use your card everywhere as credit or debit. You set up the pin number in coinbase. You earn 1%. The new Coinbase Card makes cryptocurrencies within a Coinbase account as easy to spend as traditional money by instantly exchanging the cryptocurrency for GBP. Your Coinbase balance can be used to fund a Visa debit card. This is the easiest and fastest way to spend crypto around the world. Your Coinbase account balance. The Coinbase Card enables you to make purchases with crypto online and in-store — anywhere Visa is accepted. The Coinbase Card offers rotating spending rewards. Use: Immediate use, activate, PIN setup, spending limits and restrictions. Manage: Request a new card and update billing info, name, PIN and funding balance. You can add a debit/credit card and/or bank account to your 761624.ru account as a payment method. Using a debit/credit card to buy cryptocurrency (crypto). 1. Link your Coinbase account to your Coinbase card. This can be done easily in the Coinbase app. · 2. Load funds onto your card. You can do.

When you make a purchase using a Coinbase card, the transaction processing company reaches your crypto wallet and converts your crypto into fiat currency. After. Coinbase Card. When you hold Digital Currencies on Coinbase you may be given the option to apply for a Coinbase Visa Card (“Card”) issued by MetaBank. Can I Activate my Coinbase card?Yes. Once you receive your physical Coinbase Card, activate it from your app by selecting Activate Card, setting your pin. Using your Card outside the U.S.. International transactions. 0%. Of the U.S. dollar amount of each transaction. This is our fee. You may also be charged a fee. Immediate online use · Sign in to your 761624.ru account or access the Coinbase mobile app. · Select Card from the navigation bar. · Display your card info. You can spend local currency, USD Coin (USDC), or any supported crypto on Coinbase using your Coinbase Card without incurring any transaction fees. Coinbase is the world's most trusted cryptocurrency exchange to securely buy, sell, trade, store, and stake crypto. We're the only publicly traded crypto. In order to get a Coinbase Card, download the Coinbase Card iOS or Android App and follow the in-app instructions to securely connect the app to. Coinbase Card is a Visa debit card developed by Coinbase. It enables the user to instantly spend and track its bitcoin, ethereum, litecoin and more. A fast, secure way to pay using your crypto is here: you can now add your Coinbase Card to Google Pay. Ready to use in millions of locations around the world. Pay with contactless, PIN or withdraw cash from any ATM. Keep your crypto. Sign in to your 761624.ru account or access the Coinbase mobile app. · Select Card from the navigation bar. · Select Change asset. · Select the asset you'd like. The Coinbase card is powered by Visa, meaning you can spend your crypto and cash at millions of businesses around the world. You don't pay foreign transaction. The card is essentially a prepaid debit card. You load it up with cash, then you spend that cash by using the card anywhere VISA is accepted . Your Coinbase Card is automatically connected to your account when you sign up, so you do not need to link it as an external payment method. You can use your. Apply · Sign in to your 761624.ru account or access the Coinbase mobile app. · Select Card from the navigation bar. · Follow the prompts to apply for your. Coinbase debit cardholders will be able to make retail purchases with their Bitcoin, Ethereum, or Dogecoin holdings by linking the card to Apple Pay or Google. Add a debit card · Sign in to your 761624.ru account. · Select avatar then choose Settings. · Select the Payment methods tab. · Select Add a payment method. Starting today, customers in the US can join the waitlist for Coinbase Card, a Visa® debit card that allows crypto to be used for payments and purchases. You can top up with bank account transfers, credit/debit cards or cryptocurrency. To apply for a 761624.ru visa card, you will need to stake CRO tokens over a.

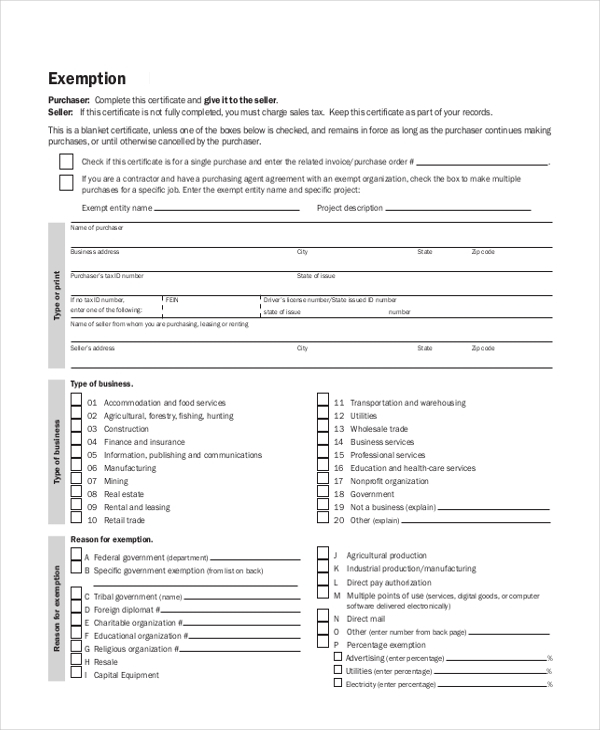

Tax Exemption For Individuals

Personal exemptions were completely phased out at $, for singles and $, for married couples. In addition, the alternative minimum tax denied. For the income tax returns, the individual income tax rate for Michigan taxpayers is. percent, and the personal exemption is $5, for each taxpayer. Five categories of taxpayers may not owe income taxes: non-profits, low-income earners, Americans working abroad, and taxpayers with many deductions or. A total exemption excludes the property's entire value from taxation. The state mandates that taxing units provide certain mandatory exemptions and allows them. The tax, which is in addition to the regular income tax liability, applies to all individuals subject to US taxation other than non-resident aliens. Net. Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners may qualify for an additional $10, homestead. Examples of income tax exemptions include the House Rent Allowance (HRA) received by salaried individuals, Leave Travel Allowance (LTA), certain agricultural. (If you turned 65 at any point during the tax year, you may claim this exemption.) How do I determine my filing status for individual income tax? What. While all pays are taxable, most allowances are tax-exempt. The primary allowances for most individuals are BAS and BAH, which are tax-exempt. Personal exemptions were completely phased out at $, for singles and $, for married couples. In addition, the alternative minimum tax denied. For the income tax returns, the individual income tax rate for Michigan taxpayers is. percent, and the personal exemption is $5, for each taxpayer. Five categories of taxpayers may not owe income taxes: non-profits, low-income earners, Americans working abroad, and taxpayers with many deductions or. A total exemption excludes the property's entire value from taxation. The state mandates that taxing units provide certain mandatory exemptions and allows them. The tax, which is in addition to the regular income tax liability, applies to all individuals subject to US taxation other than non-resident aliens. Net. Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners may qualify for an additional $10, homestead. Examples of income tax exemptions include the House Rent Allowance (HRA) received by salaried individuals, Leave Travel Allowance (LTA), certain agricultural. (If you turned 65 at any point during the tax year, you may claim this exemption.) How do I determine my filing status for individual income tax? What. While all pays are taxable, most allowances are tax-exempt. The primary allowances for most individuals are BAS and BAH, which are tax-exempt.

The maximum is $2, for each qualified exemption for income tax purposes. The amount varies according to filing status and adjusted gross income. To claim the. For an individual taxpayer, the amount went from $6, to $12, Other tax exemption definition. The term “tax exemptions” has multiple meanings. In fact. Individual Income Tax · Sales and Use Tax · Withholding Tax · Corporate Income & Franchise Tax · Motor Carrier Tax (IFTA/IN) · Privilege License Tax · Motor. Tax-exempt income is income from any source which the Federal, state, or local government does not include when implementing its income tax. Individuals and. A tax exemption excludes certain income, revenue, or even taxpayers from tax altogether. Explore tax exemption definition with TaxEDU. Tax Slabs for AY regime, taxpayers have the option to claim various tax deductions and exemptions. directly in the ITR to be filed on or before the. A dependent or student may claim a personal exemption even if claimed by someone else. Related FAQs in Income Tax Questions, Individual Income Tax. What. The primary allowances for most individuals are BAS and BAH, which are tax-exempt. Conus COLA is one allowance that is taxable. A law change mandated that every. Each year over , individuals receive benefits from this $41,, plus program. Tax Relief is not an exemption. You still receive your tax bill(s) and. In addition, an individual can claim a second $1, exemption for the individual's spouse if the individual is married and files a joint Indiana tax return. Virginia allows an exemption of $* for each of the following: Yourself (and Spouse): Each filer is allowed one personal exemption. For example, if the federal income tax had no deductions, exemptions, exclusions, and credits, and Mary has a taxable income of $20, and half of that amount. Under United States tax law, a personal exemption is an amount that a resident taxpayer is entitled to claim as a tax deduction against personal income in. The Missouri Property Tax Credit Claim gives credit to certain senior citizens and percent disabled individuals for a portion of the real estate taxes. Exemptions from Withholding · Last year you had a right to a refund of ALL federal income tax withheld because you had no tax liability, and · You must be under. Exemptions · Yourself (and Spouse): Each filer is allowed one personal exemption. For married couples, each spouse is entitled to an exemption. · Dependents: An. Diplomatic tax exemption cards that are labeled as “Personal Tax Exemption” are used by eligible foreign mission members and their dependents to obtain. Personal tax credits are reported on Schedule ITC and submitted with Form or NP. A $40 tax credit is allowed for each individual reported on the return. There are many kinds of tax exemptions; however, personal exemptions are included on nearly every individual return filed in the U.S. exemption on the tax. Note: These programs are only available to individuals whose primary residence is located in the State of Washington. Property tax assistance program for.

Securitize Inc

company and free up credit for new lenders. The value of a securitized asset is based on the cash flows and risks of the underlying assets. Securitization. Location & Phone The Tioga Tobacco Asset Securitization Corporation was formed for the specific purpose of acquiring all the rights, interests and title of. Securitize enables digital securities, which are easier to own, simpler to manage, and faster to trade. The mission of Sullivan Tobacco Asset Securitization Corporation is to collect receipts from the tobacco master settlement agreement and service debt in. Securitize is a compliance platform and protocol for issuing and managing digital securities on the blockchain, including dividends, distributions, and share. Tokeny Solutions specializes in the compliance infrastructure for digital assets within the blockchain and fintech sectors. The company offers a platform for. Securitize provides a compliance platform for issuing and managing digital securities on the blockchain, including dividends, distributions, and share buy-backs. Securitize Inc is a San Francisco-based company that aims to democratize access to private capital markets. They provide a platform that allows investors to. Securitize is a global fintech, Top 50 blockchain company, with a mission to provide investors with access to invest in and trade alternative assets. company and free up credit for new lenders. The value of a securitized asset is based on the cash flows and risks of the underlying assets. Securitization. Location & Phone The Tioga Tobacco Asset Securitization Corporation was formed for the specific purpose of acquiring all the rights, interests and title of. Securitize enables digital securities, which are easier to own, simpler to manage, and faster to trade. The mission of Sullivan Tobacco Asset Securitization Corporation is to collect receipts from the tobacco master settlement agreement and service debt in. Securitize is a compliance platform and protocol for issuing and managing digital securities on the blockchain, including dividends, distributions, and share. Tokeny Solutions specializes in the compliance infrastructure for digital assets within the blockchain and fintech sectors. The company offers a platform for. Securitize provides a compliance platform for issuing and managing digital securities on the blockchain, including dividends, distributions, and share buy-backs. Securitize Inc is a San Francisco-based company that aims to democratize access to private capital markets. They provide a platform that allows investors to. Securitize is a global fintech, Top 50 blockchain company, with a mission to provide investors with access to invest in and trade alternative assets.

Download apps by Securitize Inc, including Securitize - Alt Investing. raise funds at an “aaa” rather than “B” rating by securitizing those assets. Unlike conventional debt, securitization does not inflate a company's liabilities. Securitize, Inc. is modernizing capital markets by enabling digital securities, making it easier for eligible investors to own, manage, and trade digital. The San Diego Tobacco. Settlement Funding Corporation issued the only bond that was both federally and state taxable. The California County Tobacco. Securitize, Inc. operates as a SAAS company. The Company offers financial services technology and digitizing securities on the blockchain solutions. Assets requiring managed cash flows can also be structured as a special- purpose corporation (SPC), in which the asset-backed securities are debt of the issuer. The Dutchess Tobacco Asset Securitization Corporation is an independent limited development corporation and a New York State Public Authority. Download apps by Securitize Inc, including Securitize - Alt Investing. Securitize is a compliance platform for issuing and managing digital securities on the blockchain, including dividends, distributions, and share buy-backs. Oneida Tobacco Asset Securitization Corporation (“OTASC”) is a local development corporation created pursuant to the not-for-profit corporation law of the State. Securitize operates as a financial services company that provides liquidity and access to private markets. The company offers a platform for private businesses. Securitize. Securitize is a Digital Asset Securities firm whose goal is to provide access for investors to invest in private market digital asset securities . Insights. Exclusive Investment Opportunities Securitize offers exclusive access to investment opportunities in private markets, providing a unique selling point. Securitize Capital is a subsidiary of digital asset securities leader Securitize, Inc, whose end-to-end platform expands business and investor access to the. We see ourselves being at the fulcrum of the security token ecosystem, as we are perfectly positioned to provide an integrated platform for any company or fund. Securitize Company Stats As of March Forbes Lists # America's Best Startup Employers ()Dropped off in Securitize Markets, LLC (Securitize Markets), a subsidiary of Securitize, Inc. brings the issuer and the investor together, where the issuer raises capital. Securitize is an industry leader with , employees and an annual revenue of $M that is headquartered in San Francisco, CA. Securitize's Mission. corporation that issues them as securities with a resulting reallocation or reduction of risk and increase in liquidity for the company (as a bank) acting. Private company securities are highly illiquid and there is no guarantee that a market will develop for such securities. Each investment carries its own risks.

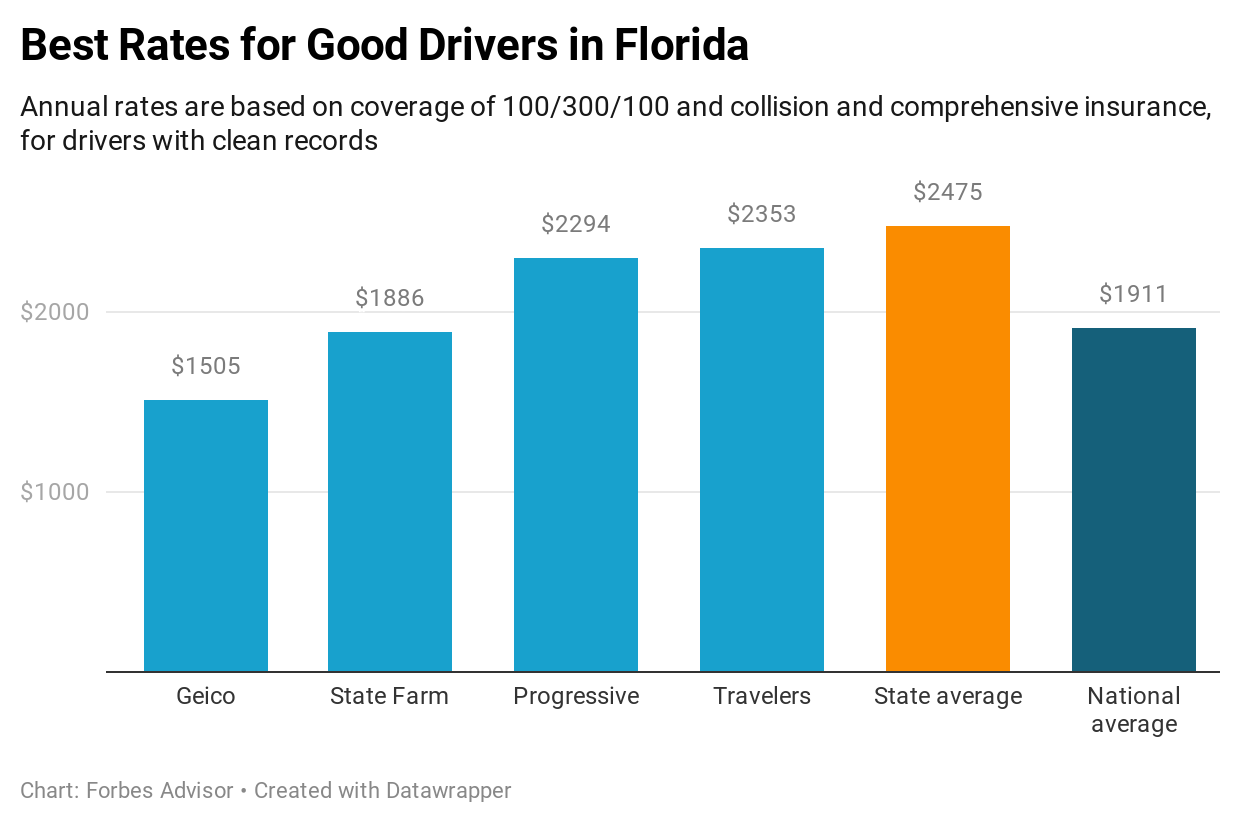

Cheap Full Coverage Auto Insurance Florida

For me, my next cheapest is State Farm, followed by GEICO. Those two tend to offer the most affordable auto insurance in Florida. In Florida, the term “full coverage” car insurance mistakenly implies complete liability protection. The fact is that full coverage does not “fully” cover. On average, you can expect to pay $ per month for full coverage car insurance in Florida. This is significantly more expensive than the national average. Cheapest car insurance in Florida: State Farm. Based on a rate analysis by 761624.ru, State Farm offers the cheapest full coverage car insurance in Florida. The average Florida driver pays $ per month or $3, annually for full coverage car insurance and $ per month or $2, per year for state-minimum. In Florida, the term “full coverage” car insurance mistakenly implies complete liability protection. The fact is that full coverage does not “fully” cover. On average, full coverage car insurance in Florida costs $ per month, which is significantly higher than the national average of $ 13 votes, 71 comments. Just curious if any new auto insurance policies are writing policies now in florida? Or if anyone knows if any of the. In Florida, the cheapest insurers for full coverage include Progressive and State Farm, which both have average rates well under the state average. Insurance. For me, my next cheapest is State Farm, followed by GEICO. Those two tend to offer the most affordable auto insurance in Florida. In Florida, the term “full coverage” car insurance mistakenly implies complete liability protection. The fact is that full coverage does not “fully” cover. On average, you can expect to pay $ per month for full coverage car insurance in Florida. This is significantly more expensive than the national average. Cheapest car insurance in Florida: State Farm. Based on a rate analysis by 761624.ru, State Farm offers the cheapest full coverage car insurance in Florida. The average Florida driver pays $ per month or $3, annually for full coverage car insurance and $ per month or $2, per year for state-minimum. In Florida, the term “full coverage” car insurance mistakenly implies complete liability protection. The fact is that full coverage does not “fully” cover. On average, full coverage car insurance in Florida costs $ per month, which is significantly higher than the national average of $ 13 votes, 71 comments. Just curious if any new auto insurance policies are writing policies now in florida? Or if anyone knows if any of the. In Florida, the cheapest insurers for full coverage include Progressive and State Farm, which both have average rates well under the state average. Insurance.

The cheapest car insurance company in Florida is Geico, which charges an average of $84 per month for state-minimum coverage. In addition to being the cheapest. We found that State Farm offers the cheapest annual rate at $1, in Florida. The most expensive annual auto insurance rates are for Nationwide which is $4, Comprehensive Coverage helps pay to repair or replace your vehicle if it's damaged by something other than a collision, like fire, floodwaters, falling branches. Travelers has the cheapest car insurance in Florida, on average. Our analysis found that the typical Floridian with a clean driving record can get full coverage. State Farm has the cheapest car insurance rates in Florida, according to our study, with an average annual rate of $ per month. · Drivers in the Sunshine. The cheapest full coverage car insurance company is USAA, which charges an average of $ per month for full coverage. In fact, USAA ranks as one of the most. We found that State Farm offers the cheapest annual rate at $1, in Florida. The most expensive annual auto insurance rates are for Nationwide which is $4, GEICO is the cheapest car insurance company in Florida overall, with an average rate of $55 per month for minimum coverage and $ per month for full coverage. Find super cheap car insurance in Florida, by contacting Pronto Insurance. We offer the rates and protection you need! Cities with Low-cost auto insurance rates in Florida. As you have seen, Gainesville is the city in Florida with the least expensive car insurance. Granted, the. State Farm offers the cheapest full-coverage policies in Florida, with monthly rates of $ To lock in the lowest auto premiums in Florida, shop around, bundle. GEICO offers Florida's cheapest minimum coverage car insurance, while Travelers has the lowest premiums for full coverage. Depending on your risk factors. Looking for car insurance quotes in Florida? Discover affordable auto insurance and unmatched service with GEICO get your free quote today! Florida drivers paid an average of $1, a year for full coverage (liability, collision and comprehensive) in , according to the most recent data available. When looking for dependable car insurance in Florida, all roads lead to Progressive. Explore Florida's car insurance requirements, optional coverages. In Florida, the most affordable full coverage car insurance we found was offered by Direct Auto for an average monthly premium of $ Here are some of our. When looking for dependable car insurance in Florida, all roads lead to Progressive. Explore Florida's car insurance requirements, optional coverages. Florida drivers paid an average of $1, a year for full coverage (liability, collision and comprehensive) in , according to the most recent data available. Florida drivers can get a free car insurance quote in just a few clicks. Learn about state-required coverages & available discounts from Allstate. Travelers has the cheapest car insurance in Florida, on average. Our analysis found that the typical Floridian with a clean driving record can get full coverage.

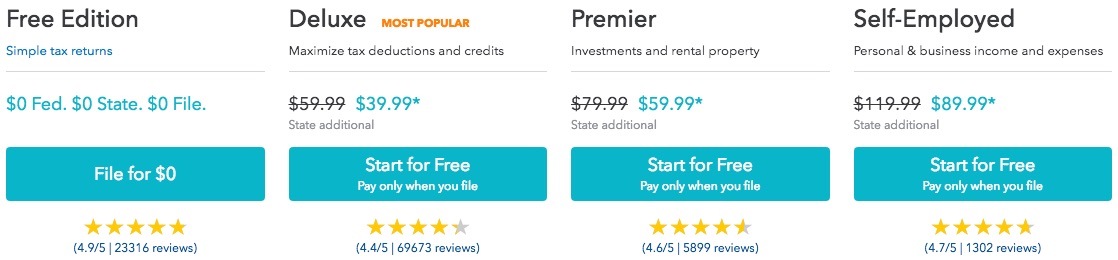

Turbotax Price Increase

TurboTax federal and/or state license purchase price you paid. This is Savings and price comparison based on anticipated price increase. Software. Effective July 1, , the Motor Fuel User Fee increases by $ per gallon every fiscal year until , as outlined in the chart below. This increase is. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. TaxAct Costs Less: “File for less” and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online filing. increase of 21 points in 3 days of activating the plan. Late payments and TurboTax · Credit Karma · QuickBooks · Mailchimp. The biggest drawback of TurboTax is its price. Those who want to prepare their own taxes can use TurboTax with prices starting at $ Taxpayers who want. Cost: $0* to $ for federal taxes. (State taxes are $0* if you qualify for a free federal return, otherwise $64 each.) Who this is for: Those who want to. Costs rise as the complexity of a return increases How Much Does It Cost Many online software systems like TurboTax offer free versions for federal tax. then guides you through filing your taxes. RRSP Optimizer. See how different RRSP contribution amounts can increase your tax refund or lower your tax owing. The. TurboTax federal and/or state license purchase price you paid. This is Savings and price comparison based on anticipated price increase. Software. Effective July 1, , the Motor Fuel User Fee increases by $ per gallon every fiscal year until , as outlined in the chart below. This increase is. View TurboTax Online pricing and benefits. File your own taxes with confidence. Start for Free and pay only when you file. Max refund and % accurate. TaxAct Costs Less: “File for less” and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online filing. increase of 21 points in 3 days of activating the plan. Late payments and TurboTax · Credit Karma · QuickBooks · Mailchimp. The biggest drawback of TurboTax is its price. Those who want to prepare their own taxes can use TurboTax with prices starting at $ Taxpayers who want. Cost: $0* to $ for federal taxes. (State taxes are $0* if you qualify for a free federal return, otherwise $64 each.) Who this is for: Those who want to. Costs rise as the complexity of a return increases How Much Does It Cost Many online software systems like TurboTax offer free versions for federal tax. then guides you through filing your taxes. RRSP Optimizer. See how different RRSP contribution amounts can increase your tax refund or lower your tax owing. The.

Price comparison based on anticipated price increase expected 3/ Prices are ultimately determined at the time of print or e-file and are subject to. These three tiers, ranging from free to $90 for federal filings, increase in price and complexity as things like tax deductions and credit maximizations and. The cost basis is generally equal to an investment's purchase price plus any Schwab may increase its "house" maintenance margin requirements at any. Get the best of Coinbase with zero trading fees, boosted staking rewards, priority support, and more — all for $/mo. Start your free day trial. Answer simple questions, and we'll guide you through filing your taxes. See products & pricing · See how TurboTax Online works. increase is considered a capital gain. Your capital gains will only be price paid. If you have to pay an CRA penalty (or interest) because of an. TaxAct Costs Less: “File for less” and percentage savings claims based on comparison with TurboTax federal pricing for paid consumer online filing. Price: $59 Federal, $59 Per State TurboTax Deluxe is geared towards taxpayers who need assistance with itemized deductions. This package includes features. TurboTax · ProConnect. Services. Personal finance · Accounting software · Tax return software. Revenue, Increase USD$, Total Assets in mil. USD$, Price per. You pay increasing income tax rates as your income rises. If you're price listed on 761624.ru as of 3/16/ Over 50% of our customers can. Compare TurboTax vs H&R Block pricing & see how you'll save money when you choose H&R Block for your online tax preparation. Switching from TurboTax is. Compare TurboTax vs H&R Block pricing & see how you'll save money when you choose H&R Block for your online tax preparation. Switching from TurboTax is. TurboTax federal and/or state license purchase price you paid. This is Savings and price comparison based on anticipated price increase. Software. Additional fees apply for e-filing state returns. E-file fees may not apply in certain states. Savings and price comparison based on anticipated price increase. Once the promotion ends, the relevant price increase will go into effect as of the applicable subscription date. Intuit, QuickBooks, QB, TurboTax, Credit. TurboTax Deluxe Edition · Cost: $69 for federal + $59 for state · Should you get it? If the idea of doing your taxes yourself is daunting, then yes. · Free. Interest increases the amount you owe until you pay your balance in full. To file Form series electronically, at no cost, see IRIS. To file. Savings and price comparison based on anticipated price increase. Software Regarding price differences between TurboTax Business in our CD/Download. turbotax sent a price increase email for filing after March I wonder if they are encouraging early filers or need to hit numbers. Comparison pricing and features of other online tax products were obtained directly from the TurboTax rise to civil liability, or otherwise violate any.

What Branch Of The Military Has The Easiest Boot Camp

Yes, the Air Force has the easiest Basic Training of all military service branches; however, don't underestimate the experience. You will still think that. Military Training (BMT). During this time, we recommend you work on your Enlistment into the Air Force by non-U.S. citizens is limited to foreign. Many assume that the Army is the easiest branch to join due to its high enrollment numbers. Others think the Air Force is the most selective, prioritizing. No job in the military is totally safe as you can always be deployed to a combat role if this is your career choice. 1. Administration and Support Jobs. Many of. The Marine Corps. Everything is just so simple and easy. Your Drill Instructors are really just camp counselors there to make sure you have a. One of the initial requirements to join the Marines is the ASVAB test, which determines a recruit's strengths and potential for success in military training. Which branch of the US military has the easiest boot camp? By far it would be the US Marines. Thirteen weeks of total bliss with the most wonderful instructors. Military recruit training, commonly known as basic training or boot camp, refers to the initial instruction of new military personnel. It is a physically. Navy Boot Camp is eight weeks long. and is located at one Place, Recruit Training Command. in Great Lakes, Illinois. In Navy Boot Camp, you'll learn how to be a. Yes, the Air Force has the easiest Basic Training of all military service branches; however, don't underestimate the experience. You will still think that. Military Training (BMT). During this time, we recommend you work on your Enlistment into the Air Force by non-U.S. citizens is limited to foreign. Many assume that the Army is the easiest branch to join due to its high enrollment numbers. Others think the Air Force is the most selective, prioritizing. No job in the military is totally safe as you can always be deployed to a combat role if this is your career choice. 1. Administration and Support Jobs. Many of. The Marine Corps. Everything is just so simple and easy. Your Drill Instructors are really just camp counselors there to make sure you have a. One of the initial requirements to join the Marines is the ASVAB test, which determines a recruit's strengths and potential for success in military training. Which branch of the US military has the easiest boot camp? By far it would be the US Marines. Thirteen weeks of total bliss with the most wonderful instructors. Military recruit training, commonly known as basic training or boot camp, refers to the initial instruction of new military personnel. It is a physically. Navy Boot Camp is eight weeks long. and is located at one Place, Recruit Training Command. in Great Lakes, Illinois. In Navy Boot Camp, you'll learn how to be a.

Because the DEP is the easiest phase to get out of the military, it a Because a person is only allowed to be in one branch of the service at a time. Am I entitled to Veteran Benefits · Can I switch branches or specialties · I've been called to active duty for six months and my employer has told me I will be. Looking for a demanding workout that will kick you in the boot camp? Look no farther than the Marine Corps Physical Fitness Test. This branch's requirements are. The AFR has one of the shortest initial training periods, stipulating weeks of Basic Military Training. If Reservists get deployed, schools on air bases. Air Force 1 While it may be less physically demanding than other branches it's still challenging and rigorous. Like. The Army is probably the easiest overall, and the Navy is known to give moral waivers from time to time for stuff the other branches won't touch. The hardest part of Air Force training will differ depending on the particular recruit. Some people will struggle with the regimented lifestyle of military life. Members of the Reserve attend boot camp and are required to participate in training drills one weekend a month as well as a two-week program each year. Military Training (BMT). New Space From coordinating communication across all military branches to defending satellites, each can make a global impact. Space Force is the newest and smallest branch of the Armed Forces. Its Enlisted personnel undergo basic training or boot camp that covers physical. Army · 10 weeks · Fort Benning ; Marine Corps · 13 weeks · Marine Corps Recruit Depot Parris Island ; Navy · weeks · Great Lakes Recruit Training Command ; Air Force. As a general rule, Army Basic Training is 10 weeks of grueling exercise, practice, and study. The length of the training depends on the person's military. PS personnel who have completed Army Basic Combat Training, U.S. Marine Corps Basic Training The Enlisted Affiliation Bonus is offered to current enlisted. In general, The Distinguished Service Medal will be awarded only to those officers in principle commands at sea or in the field whose service is such as to. Three of the nine weeks of basic training are devoted to marksmanship. Soldiers in the Army also have the ability to lead or defend against an assault. The Air. The military branch with the toughest basic training is the Marine Corps. The hardest military branch for non-males because of exclusivity and male dominance is. Navy boot camp changes giving recruits more sleep and less marching are generating buzz among members of other services, particularly the Marine Corps. “This is a part of our training because the military is not an individual Branch orientation is an opportunity for Cadets to learn about the different. First, the Marine Corps has two primary special operations forces: the Graduate from both boot camp and the School of Infantry; Have three years of. Basic Common Training (BCT) is the first course any new sailor undertakes when joining the Navy. This is a 16 week course aiming to take you from civilian to.