761624.ru Market

Market

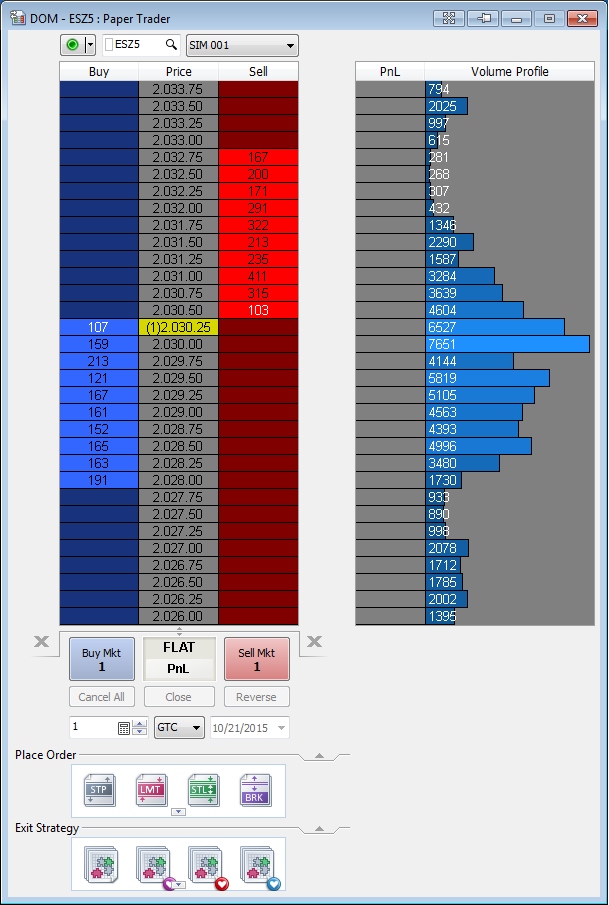

Depth Of Market Software

software errors, Internet traffic, outages and other factors Securities and futures trading is offered to customers by TradeStation Securities, Inc. The itcMarketDepth is an indicator for level 2 reading. Reading the market depth helps traders confirm support and resistance levels. Being able to read the. Depth of market is a tool that allows traders to see the number of buys and sells for an asset at different prices, giving a wider understanding of supply and. Order Flow Market Depth Map. Historic and real-time visualization of the limit order book giving you clear insight of market depth and order flow. See the. Jigsaw's trading Depth of Market (DOM) is built based on proprietary trading techniques that institutional traders use to trade on the price ladder. software errors, Internet traffic, outages and other factors Securities and futures trading is offered to customers by TradeStation Securities, Inc. Trading Platform/Tool that scans Depth of Market (DOM) for conditions and alerts you? I recommend sierra chart. Anything you could imagine. Trail of Intentions (TINT) is an RTX Extension designed to display historical snapshots of the depth of market (order book). The market depth provides numeric. The Depth of market tool allows you apply complex trading strategies (OCO, GTC, FOK, IOC STP LIMIT, Trailing Stops, Brackets), launch associated contract charts. software errors, Internet traffic, outages and other factors Securities and futures trading is offered to customers by TradeStation Securities, Inc. The itcMarketDepth is an indicator for level 2 reading. Reading the market depth helps traders confirm support and resistance levels. Being able to read the. Depth of market is a tool that allows traders to see the number of buys and sells for an asset at different prices, giving a wider understanding of supply and. Order Flow Market Depth Map. Historic and real-time visualization of the limit order book giving you clear insight of market depth and order flow. See the. Jigsaw's trading Depth of Market (DOM) is built based on proprietary trading techniques that institutional traders use to trade on the price ladder. software errors, Internet traffic, outages and other factors Securities and futures trading is offered to customers by TradeStation Securities, Inc. Trading Platform/Tool that scans Depth of Market (DOM) for conditions and alerts you? I recommend sierra chart. Anything you could imagine. Trail of Intentions (TINT) is an RTX Extension designed to display historical snapshots of the depth of market (order book). The market depth provides numeric. The Depth of market tool allows you apply complex trading strategies (OCO, GTC, FOK, IOC STP LIMIT, Trailing Stops, Brackets), launch associated contract charts.

Beyond Level 1, at more than 20x the liquidity of Level 2, Nasdaq offers the most complete market book with all the information you need to bring your. The abilty to read the profile is one of the most important key for a successfully market analysis with the volume and it is also not so easy, because when we. Market depth considers the overall level and breadth of open orders and is calculated from the number of buy and sell orders at various price levels on each. This service same as Market Depth Service(//blp/mktdepthdata).it also support both "Market By Order" (MBO) and aggregated Market By position (MBP) data. Discover the TOP 7 DOM (Depth of Market) trading platforms that empower traders with real-time market data and advanced order book insights. This industry-standard tool shows market depth, volume profile and provides one-click trading. MultiCharts' DOM displays ten price levels each way. Market depth considers the overall level and breadth of open orders and is calculated from the number of buy and sell orders at various price levels on each. DOM data is available from most online brokers for free or for a small fee. Understanding DOM. By measuring real-time supply and demand, market depth is used by. Trade from anywhere you have an Internet connection with no software to install or maintain. See real-time market data, market depth and time and sales in. The Depth of Market is a measure of the total amount of the open Buy and Sell orders for a symbol at different prices. Depth of Market (DOM) is a window that displays the real-time market activity at different price levels in a security or currency market. Sierra Chart - Financial Market Charting and Trading Software Market Depth Historical Graph feature to display historical market depth data on charts. Overview Have you ever heard of a broker offering market depth access to its clients? We definitely let you do that as easy as one button click PCM Market. trading software displays depth-of-mar- ket data in a table (see Table 1), which updates every 30 seconds or so. The top of the table displays the high- est. Market depth is the ability of a market to stabilize prices even in the face of massive orders. Here's why it matters for retail traders. The Market Depth feature allows you to access the complete order book, giving visibility into every bid and offer made in a market. This enables you to assess. The itcMarketDepth is an indicator for level 2 reading. Reading the market depth helps traders confirm support and resistance levels. Being able to read the. Market Data Visualization in The Era of HFT and AI High-frequency trading computers can execute round-trip trades within milliseconds. Artificial intelligence. The Depth of Market (DOM) displays bids and asks for a particular instrument at the currently best prices (closest to the market). What is DOM Trading Platform? Market Depth of (DOM) trading is a fundamental analysis that considers the supply and demand for a particular.

Simple Money Tracking App

![]()

Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! The simple fact is, by tracking your. Track & categorize your spending. Get an automatic, fully customizable spending plan. Reach your savings goals. Plan for the future with projected cash flows. "Simple Money" is a simple and easy-to-use budgeting app. By setting a monthly budget and managing it, you can easily save and manage your expenses. Lunch Money is a budgeting app with multi currency & cryptocurrency support for the modern day spender. Meet your biggest cheerleader in personal finances! Is an open-source progressive web app that allows you to track your income and expenses. This app can work offline on desktop, tablet and mobile. Your all-in-one expense management app. Automatically scan receipts, track mileage, and create expense reports with Easy Expense! Spending Tracker is a standout expense manager app that excels in user-friendliness and simplicity, making it one of the best tools available for managing. One of the best online money management apps out there, Empower is a free tool that allows you to create a budget, track your spending, and save. Connect all of. I am looking for a way to track my cash expenses with an app. It doesn't need much, I just want to input the amount and the description (or preset caregory) of. Spending Tracker is the easiest and most user friendly Personal Finance App in the store. And best of all, it's free! The simple fact is, by tracking your. Track & categorize your spending. Get an automatic, fully customizable spending plan. Reach your savings goals. Plan for the future with projected cash flows. "Simple Money" is a simple and easy-to-use budgeting app. By setting a monthly budget and managing it, you can easily save and manage your expenses. Lunch Money is a budgeting app with multi currency & cryptocurrency support for the modern day spender. Meet your biggest cheerleader in personal finances! Is an open-source progressive web app that allows you to track your income and expenses. This app can work offline on desktop, tablet and mobile. Your all-in-one expense management app. Automatically scan receipts, track mileage, and create expense reports with Easy Expense! Spending Tracker is a standout expense manager app that excels in user-friendliness and simplicity, making it one of the best tools available for managing. One of the best online money management apps out there, Empower is a free tool that allows you to create a budget, track your spending, and save. Connect all of. I am looking for a way to track my cash expenses with an app. It doesn't need much, I just want to input the amount and the description (or preset caregory) of.

We chose QuickBooks Accounting as the best expense tracking app for small businesses because users can send and track invoices and automatically track mileage. Meet your financial goals with Piere's budget planner app. Our free budget tracker empowers your goals with custom personal finance insights. Simple budget tracking app. Made 761624.ru Maui. Contribute to MattKayDev/BudgetAppByMKD development by creating an account on GitHub. Free multi-award-winning budgeting and money management app. Snoop works 24/7, tracking your spending and finding smart ways to save on your bills. Best expense tracker apps · Best app for planners: Quicken Simplifi · Best app for serious budgeters: You Need a Budget (YNAB) · Best app for beginners: Goodbudget. Clarity Money is an expense tracking, budgeting and bill negotiating app. It allows you to link your checking and credit accounts, credit and debit card. Four Budgeting Apps You Should Check Out · 1. Mint · 2. Spendee · 3. You Need A Budget (YNAB) · 4. Pocket Guard. Our Top Tested Picks · Simplifi · Quicken Classic · YNAB · Greenlight · Monarch · NerdWallet · PocketGuard · Rocket Money. We chose QuickBooks Accounting as the best expense tracking app for small businesses because users can send and track invoices and automatically track mileage. Money Pro is a simple tool to track and manage your finances with ease and deep understanding. It will help you cut spending, achieve financial goals, and. A monthly expense tracker app automates the process of recording transactions, totaling expenses by category and tracking progress toward goals. Goodbudget is a budget tracker for the modern age. Say no more to carrying paper envelopes. This virtual budget program keeps you on track with family and. MoneyPatrol is designed to be an advanced Money Tracking, Financial Account Monitoring and Alerting application that securely monitors your financial accounts. Best budgeting apps: · Monarch Money: Best budgeting app for couples and families · Rocket Money: Best budgeting app for bill negotiation · You Need a Budget: Best. Get the easiest free app to track small business & personal expenses. Manage your expenses and make a budget on the go. View all of your expenses in one. Wally is a colorful app with lots of great expense-tracking functionality. You can use Wally on an iOS device, and the basic version of the app is free. As with. Budgeting. Track your spending with budgets. You can only budget cash you have on hand, which means your budget stays realistic and you don't make numbers up. Manage your personal finances and easily track your money, expenses and budget. Get the easiest free app to track small business & personal expenses. Manage your expenses and make a budget on the go. View all of your expenses in one. 1. You Need a Budget (YNAB). YNAB offers a hands-on approach to money management by making you account for every single dollar earned. · 2. Mint · 3. Mvelopes · 4.

Best Crypto Etf Fidelity

The 5 Best Crypto ETFs of · Valkyrie Bitcoin Miners ETF · Bitwise Crypto Industry Innovators ETF · Invesco Alerian Galaxy Crypto Economy ETF · Global X. Bitcoin ETF List ; Fidelity, FBTC, $B · %, N/A ; 21 Shares & ARK, ARKB, $M · %, No fees for the first 6 months OR first $1B of inflows ; Blackrock. Best Fit Digital Assets · #1. Fidelity Crypto Industry&DgtlPymntsETF FDIG · 2x Bitcoin Strategy ETF BITX · 2x Ether ETF ETHU · Amplify Transformational Data Shrg. Return comparison of all Bitcoin ETFs/ETNs ; Fidelity Physical Bitcoin ETP, +% ; WisdomTree Physical Bitcoin, +% ; CoinShares Physical Bitcoin, +%. 2nd Choice: Fidelity Advantage Bitcoin ETF ; Management Fee: % ; Management Expense Ratio (MER): % This recently dropped from % in recent months. It. Fidelity Physical Bitcoin ETP (Primary Ticker FBTC) is an exchange traded product (ETP) which aims to track the price of Bitcoin. The second way is to buy crypto-related exchange-traded funds (ETFs). Broadly speaking, there are 2 types of crypto-related ETFs. Stock-based ETFs give you. iSHARES BITCOIN TRUST ETF (IBIT). Introducing IBIT, which gives investors To better understand the similarities and differences between investments. This product is for investors with a high risk tolerance. It invests in a single asset, bitcoin, which is highly volatile and can become illiquid at any. The 5 Best Crypto ETFs of · Valkyrie Bitcoin Miners ETF · Bitwise Crypto Industry Innovators ETF · Invesco Alerian Galaxy Crypto Economy ETF · Global X. Bitcoin ETF List ; Fidelity, FBTC, $B · %, N/A ; 21 Shares & ARK, ARKB, $M · %, No fees for the first 6 months OR first $1B of inflows ; Blackrock. Best Fit Digital Assets · #1. Fidelity Crypto Industry&DgtlPymntsETF FDIG · 2x Bitcoin Strategy ETF BITX · 2x Ether ETF ETHU · Amplify Transformational Data Shrg. Return comparison of all Bitcoin ETFs/ETNs ; Fidelity Physical Bitcoin ETP, +% ; WisdomTree Physical Bitcoin, +% ; CoinShares Physical Bitcoin, +%. 2nd Choice: Fidelity Advantage Bitcoin ETF ; Management Fee: % ; Management Expense Ratio (MER): % This recently dropped from % in recent months. It. Fidelity Physical Bitcoin ETP (Primary Ticker FBTC) is an exchange traded product (ETP) which aims to track the price of Bitcoin. The second way is to buy crypto-related exchange-traded funds (ETFs). Broadly speaking, there are 2 types of crypto-related ETFs. Stock-based ETFs give you. iSHARES BITCOIN TRUST ETF (IBIT). Introducing IBIT, which gives investors To better understand the similarities and differences between investments. This product is for investors with a high risk tolerance. It invests in a single asset, bitcoin, which is highly volatile and can become illiquid at any.

Cryptocurrency-related ETFs and Mutual Funds · Schwab Crypto Thematic ETF · Additional ETFs & Mutual Funds. The iShares Bitcoin Trust ETF seeks to reflect generally the performance of the price of bitcoin. The iShares Bitcoin Trust ETF is not an investment company. 2nd Choice: Fidelity Advantage Bitcoin ETF ; Management Fee: % ; Management Expense Ratio (MER): % This recently dropped from % in recent months. It. FBTC | A complete Fidelity Wise Origin Bitcoin Fund exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF. There are lots of great ALTS like ETH and SOL, which should a small part of any crypto portfolio. Besides, if you really knew anything, you'd. The iShares Bitcoin Trust ETF seeks to reflect generally the performance of the price of bitcoin. The iShares Bitcoin Trust ETF is not an investment company. FBTC is for investors with a high risk tolerance. It invests in a single asset, bitcoin, which is highly volatile and can become illiquid at any 761624.ru is. Performance Comparison ; FBTC. Fidelity Wise Origin Bitcoin Fund. ; IBIT. IShares Bitcoin Trust Registered. ; BTCO. Invesco Galaxy Bitcoin ETF. iSHARES BITCOIN TRUST ETF (IBIT). Introducing IBIT, which gives investors To better understand the similarities and differences between investments. Amplify Transformational Data Sharing ETF · $ billion · % ; First Trust Indxx Innovative Transaction & Process ETF · $ million · % ; Fidelity Crypto. Fidelity ETFs ; FCOM · Fidelity MSCI Communication Services Index ETF. Equity ; FDIS · Fidelity MSCI Consumer Discretionary Index ETF. Equity ; FSTA · Fidelity. Why invest in this ETF? · The ETF invests directly in bitcoin, with the security of Fidelity's in-house storage services. · Provides exposure to one of the. Crypto ETFs/ETNs in comparison ; WisdomTree Physical EthereumGB00BJYDH, ; VanEck Solana ETNDEA3GSUD3, 69 ; Fidelity Physical Bitcoin ETPXS, Fidelity Crypto Industry & Digital Payments ETF ; Net Expense Ratio % ; Turnover % 55% ; Yield % ; Dividend $ ; Ex-Dividend Date Dec 15, Amplify Transformational Data Sharing ETF · $ billion · % ; First Trust Indxx Innovative Transaction & Process ETF · $ million · % ; Fidelity Crypto. Answer: ProShares Bitcoin Strategy ETF, Grayscale Bitcoin Trust, Grayscale Ethereum Trust, Bitwise 10 Crypto Index Fund, Valkyrie Bitcoin Strategy ETF, VanEck. 6. Fidelity Crypto Industry and Digital Payments ETF (FDIG) The success of international blockchain, cryptocurrency, and digital payment enterprises is. Fidelity ETFs ; FCOM · Fidelity MSCI Communication Services Index ETF. Equity ; FDIS · Fidelity MSCI Consumer Discretionary Index ETF. Equity ; FSTA · Fidelity. Find the latest quotes for Fidelity Crypto Industry and Digital Payments ETF (FDIG) as well as ETF details, charts and news at 761624.ru

Connexus Personal Loan

Connex's Skip-A-Payment program lets you defer one full monthly loan payment and allocate the money towards other uses. According to 2, Connexus Credit Union offers APRs ranging from % to % for personal loans, which means they do offer APRs below 18% for fair credit. The Conexus personal loan is a perfect fit for members looking to supplement their savings to finance their next big thing. credit cards, as well as personal, auto, and home loans. Connexus Credit Union primarily serves individual consumers with financial solutions designed to. Connexus Credit jobs available on Indeed Compliance OfficerLoan ProcessorPersonal BankerService TechnicianTellerWork from home careersView more careers. lending. Specializing in originating or refinancing auto, recreational, and personal loans, I'm proud to serve members across all 50 states from our. Connexus Credit Union reviews, contact info, products & FAQ. Get the full story from fellow consumers' unbiased Connexus Credit Union reviews. loan or personal loan read more. Recommended Reviews - Connexus Credit Union. Your trust is our top concern, so businesses can't pay to alter or remove their. Applicants with a credit score of at least and up to may be eligible for Connexus Credit Union Personal Line of Credit. The minimum age to be eligible. Connex's Skip-A-Payment program lets you defer one full monthly loan payment and allocate the money towards other uses. According to 2, Connexus Credit Union offers APRs ranging from % to % for personal loans, which means they do offer APRs below 18% for fair credit. The Conexus personal loan is a perfect fit for members looking to supplement their savings to finance their next big thing. credit cards, as well as personal, auto, and home loans. Connexus Credit Union primarily serves individual consumers with financial solutions designed to. Connexus Credit jobs available on Indeed Compliance OfficerLoan ProcessorPersonal BankerService TechnicianTellerWork from home careersView more careers. lending. Specializing in originating or refinancing auto, recreational, and personal loans, I'm proud to serve members across all 50 states from our. Connexus Credit Union reviews, contact info, products & FAQ. Get the full story from fellow consumers' unbiased Connexus Credit Union reviews. loan or personal loan read more. Recommended Reviews - Connexus Credit Union. Your trust is our top concern, so businesses can't pay to alter or remove their. Applicants with a credit score of at least and up to may be eligible for Connexus Credit Union Personal Line of Credit. The minimum age to be eligible.

Serving more than , members nationwide, Wausau, WI-based Connexus Credit Union is a member-owned, not-for-profit financial cooperative with $ billion. Achieve your goals with a personal loan. We offer a range of term lengths and interest rates, all to ensure your payments fit your budget. Manage your money anytime, anywhere with the Connexus Credit Union app. Safe and secure, this mobile app allows you to view your transaction history. Explore Aqua Finance for diverse financing options. Specializing in consumer financing, we offer tailored solutions to fit your financial needs. Connexus Credit Union offers secured and unsecured personal loans with broad loan amounts, flexible repayment terms, competitive interest rates, and solid rate. Ronald J can teach you about the variety of loan products CMG provides including conventional loans, FHA home loans, VA home loans, Jumbo loans, home. Connexus Credit Union. Banks & Credit Unions. Closed. Unclaimed. Add Review · Call loans, Visa® credit cards, and personal loans. History. Established in Personal loan lender reviews · Personal loans calculator · Average personal loan Connexus Credit Union savings account. Connexus Credit Union Logo. NCUA. Rate History for Connexus Credit Union. Recent Rates for Connexus Credit Union. Connexus Credit Union rates. Updated Daily Personal Loans & Lines of Credit. Personal identification · A current Passport or Birth Certificate · Driver's Licence. · Other documents that will be useful: a Medicare card, Credit card, ATM/. Personal and Recreational Vehicle Loans · Personal Loan · E-Bike Loan · Recreational Vehicle Loans · Making your Payment is Easy! Pay Your Connex Loan With. lender. Apply for an Auto Loan with Connexus to Check it out now · 761624.ru 5 Smart Uses for a Personal Loan - Connexus Credit. loan amount. Term. 24 - 84 months. Accepted Credit. Excellent. Editors' Thoughts. Why It's One of the Best Credit Unions for Personal Loans: Connexus Credit. When coming to Canada, I immediately chose Conexus. I have a personal banker and mortgage agent. I earned over $ in interest on my savings. Mortgage; VA Home Loans; Mortgage Refinance; Home Equity; Home Equity Line of Credit (HELOC); Personal Loans & Lines of Credit. Select Product. Checking. I did not authorize any of my personal information or my loan to be sold or transferred from Aqua to Connexus. This is breach of trust and privacy. This was. A better mortgage experience starts now with Connexus Credit Union. Learn personal financial information from you and from other sources about your. personal loan reviews and recommendations to help you find the right personal loan Connexus Credit Union Personal Loans Review for By. Ben Luthi. Open a new Auto, Personal, or Recreational Loan by September 30, , to automatically be entered in the Connexus $1K Giveaway.* You could be our lucky. personal, auto, and home loans. Connexus Credit Union primarily serves individual consumers with financial solutions designed to meet their savings.

Chase 300 Offer

You can earn $ by opening a new Total Checking account and receiving $ in direct deposits, giving you an excellent 60% return on your deposit. The Chase Freedom Flex can earn you a $ bonus if you spend $ in the first three months. The Chase Freedom Unlimited is currently offering an extra They are saying if i sign up for a debit card and get my direct deposit through them i'll get a dollar bonus. Is Chase a bad bank to use. Earn a $ welcome bonus if you have more than $ of direct deposits However, many banks, including Chase, offer teen checking accounts to give. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking account 1 and make direct deposits totaling $ or more within 90 days of. Find Chase Total Checking bonus and offer coupons here. Earn $ bonus when you set up direct deposit using a Chase Bank checking account. The Chase Total Checking account offers a $ bonus for new customers when you open a Chase Total Checking account and make direct deposits totaling $ or. Chase offers a $ bonus for most new checking customers, but bonuses can be as high as $ for people with large accounts. Receive an introductory $ bonus. Get $ when you open a Chase Business Complete Checking® account with qualifying activities. For new business checking. You can earn $ by opening a new Total Checking account and receiving $ in direct deposits, giving you an excellent 60% return on your deposit. The Chase Freedom Flex can earn you a $ bonus if you spend $ in the first three months. The Chase Freedom Unlimited is currently offering an extra They are saying if i sign up for a debit card and get my direct deposit through them i'll get a dollar bonus. Is Chase a bad bank to use. Earn a $ welcome bonus if you have more than $ of direct deposits However, many banks, including Chase, offer teen checking accounts to give. Enjoy $ as a new Chase checking customer, when you open a Chase Total Checking account 1 and make direct deposits totaling $ or more within 90 days of. Find Chase Total Checking bonus and offer coupons here. Earn $ bonus when you set up direct deposit using a Chase Bank checking account. The Chase Total Checking account offers a $ bonus for new customers when you open a Chase Total Checking account and make direct deposits totaling $ or. Chase offers a $ bonus for most new checking customers, but bonuses can be as high as $ for people with large accounts. Receive an introductory $ bonus. Get $ when you open a Chase Business Complete Checking® account with qualifying activities. For new business checking.

Chase is offering a bonus of $ when you open a new Chase Total Business checking account and complete the following requirements. A balance at the beginning of each day of $ or more in this account · OR $25 or more in total Autosave or other repeating automatic transfers from your. Checking Portion – $ Bonus · Must be done within 90 days of coupon enrollment · Doesn't seem to be an amount requirement, just says no micro deposits (less. Our Chase College CheckingOpens in a new window account has great benefits for students and new Chase checking customers can enjoy this special offerOpens in a. Get more from a personalized relationship when you open a new Chase Private Client Checking account with qualifying activities. Earn $ when you open a Business Complete Checking ®,1 account. For new business checking customers with qualifying activities. Chase Bank Business Checking Bonus: $ Offer Coupon – Ends 10/17/24 · Open a new Chase Business Complete Checking® account. · Fund: Deposit a total of $2, JPMorgan Chase Bank is currently offering a bonus of $ when you open a personal checking account and $ when you open a savings account. Save at Chase Bank with top coupons & promo codes verified by our experts. Choose the best offers & deals starting at $ off for August ! A balance at the beginning of each day of $ or more in this account See our Chase Total Checking offer for new customers. Make purchases with. How to earn the bonus: You'll earn a $ bonus when you open a Chase Business Complete Checking account, deposit at least $2, within 30 days and maintain. The fine print: The Chase Business Complete Checking $ bonus offer is unavailable to existing customers with business checking accounts, as well as. Open a new Chase Secure Banking account online or enter your email address to get your coupon and bring it to a Chase branch to open an account. 2. Complete Find many great new & used options and get the best deals for Chase Bank $ Bonus Checking @ Account Opening Coupon Expires 7/24/ at the best online. A balance at the beginning of each day of $ or more in this account See our Chase Total Checking offer for new customers. Make purchases with. 1. Chase Total Checking® – $ Bonus Looking for a great Chase checking account bonus? The Chase Total Checking® account is an excellent choice. For a. To earn $, open a new Total Checking account and have direct deposits of at least $ within 90 days of signing up for a Chase offer coupon. To qualify for. $ in the account, at least $25 in total Autosave or other repeating Both Chase savings accounts offer an underwhelming APY. Over a year. We like their more than 4, branches, new customer coupons, and full service banking. $ Chase Total Checking® - $ Bonus · Open an Account. Expires 10/. Checking features to help your business thrive. Every Chase business checking account offers: Chase Business Online and Online Bill Pay Footnote.

High Interest Cd S

Find a high yield CD account from Discover. Compare online CD rates and choose the best CD term to reach your financial goals. Open a CD online today. Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate doesn't change until your CD. CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts, depending on the market. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum. Frost Certificate of Deposit Account · Earn % APY on 90 Day Jumbo CDs · % · Higher rates worth your interest · We'll do our part to get you to and through. CDs are similar to savings accounts, but they are set to a fixed term (usually ranging from one month to ten years) and a fixed interest rate. It is expected. The highest 4-year CD rate today is % from First National Bank of America. Best 5-year CD rates. The highest 5-year CD rate today is % from First. For Money Market and High Yield Savings Accounts, the rate may change after the account is opened. For CD accounts, a penalty may be imposed for early. A Marcus High-Yield CD is a type of deposit account that, depending on the term, usually offers a higher Annual Percentage Yield (APY) than a traditional. Find a high yield CD account from Discover. Compare online CD rates and choose the best CD term to reach your financial goals. Open a CD online today. Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate doesn't change until your CD. CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts, depending on the market. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum. Frost Certificate of Deposit Account · Earn % APY on 90 Day Jumbo CDs · % · Higher rates worth your interest · We'll do our part to get you to and through. CDs are similar to savings accounts, but they are set to a fixed term (usually ranging from one month to ten years) and a fixed interest rate. It is expected. The highest 4-year CD rate today is % from First National Bank of America. Best 5-year CD rates. The highest 5-year CD rate today is % from First. For Money Market and High Yield Savings Accounts, the rate may change after the account is opened. For CD accounts, a penalty may be imposed for early. A Marcus High-Yield CD is a type of deposit account that, depending on the term, usually offers a higher Annual Percentage Yield (APY) than a traditional.

CD account & rates ; · 1 year online CDs. % ; · 2 year online CDs. % ; · 5 year online CDs. %. CD rate news The best CDs currently range from % to % — with some promo rates as high as % — which is higher than average compared with the. For Money Market and High Yield Savings Accounts, the rate may change after the account is opened. For CD accounts, a penalty may be imposed for early. BMO Alto Online Certificates of Deposit (CDs). Grow your savings with our high-yield online-only CD s. No minimum balance; $0 minimum opening deposit; 6. Today's Standard Fixed Rate CDs ; 3 month · %. % ; 6 month · %. % ; 1 year · %. %. High-yield CDs: Similar to a high-yield savings account, a high-yield CD offers a substantially higher rate of interest than regular CDs. The catch is that you. Better interest rates. CDs typically pay higher interest rates than other deposit products ; Guaranteed return. Interest rate doesn't change until your CD. BMO Alto Online Certificates of Deposit (CDs). Grow your savings with our high-yield online-only CD s. No minimum balance; $0 minimum opening deposit; 6. Compare CDs ; High Yield CD. (2, Reviews). AVAILABLE TERMS ; Raise Your Rate CD. (2, Reviews). AVAILABLE TERMS ; No Penalty CD. (1, Reviews). If a CD has a step rate, the interest rate of the CD may be higher or lower than prevailing market rates. Step-rate CDs are subject to secondary-market risk. With certificates of deposit (CD), you choose the term and your rate is fixed, so you always know what you'll earn and when you'll earn it. Check today's higher. Right now, the best 1-year CD rate is % APY from multiple institutions. Compare the highest 1-year CD rates available nationwide and their minimum. With a CD, you're only allowed an initial one-time deposit. If you're interested in making monthly or recurring deposits, a High Yield Savings Account. CDs are bank deposits that pay a stated amount of interest for a specified period of time and promise to return your money on a specific date. Mix CDs of varying term lengths and rates for long-term returns and more frequent access to your money. Take A Closer Look. Get more. CDs (Certificate of Deposit). Unlike music CDs – your CD earnings never get old! open an account. With a CD, you're only allowed an initial one-time deposit. If you're interested in making monthly or recurring deposits, a High Yield Savings Account. Get higher interest rates on your savings. Make the most of your savings with KeyBank tiered long-term CDs to earn a great fixed rate for the life of your CD. Deposit at least $ within 10 days of opening your CD to receive the highest published interest rate and Annual Percentage Yield (APY) we offer for your CD's.

What Is Good Life Insurance Amount

If you're a year-old woman who doesn't smoke, you can expect to pay about $1, per month on average for a $1 million whole life policy. For a man of the. COMPARE YOUR LIFE INSURANCE OPTIONS · Your payments (premiums) · Payout for loved ones (death benefit) · Builds. cash value · Guaranteed cash value growth. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. Premium: This is the payments that the policyholder makes to the insurer, which can be monthly, semiannually, or yearly. Cash value: Whole life policies have a. Whole life insurance – the premium remains the same for life, the death When deciding what life insurance is right for you, again, be sure to read. Essentially, a $1m policy produces an effective income for your family of between $65, and $75, over 10 years, assuming your wife leaves. A good amount of life insurance is an amount that will provide a death benefit that can protect your family from financial struggle, as well as one that you can. The average annual term life insurance premium for a year-old preferred applicant in good health is between $ and $ per year. The policy you purchase should have a death benefit of at least this amount, if you can afford it. With term life insurance, you can typically choose a coverage. If you're a year-old woman who doesn't smoke, you can expect to pay about $1, per month on average for a $1 million whole life policy. For a man of the. COMPARE YOUR LIFE INSURANCE OPTIONS · Your payments (premiums) · Payout for loved ones (death benefit) · Builds. cash value · Guaranteed cash value growth. According to eFinancial, the cost of a year, $, term life insurance policy is typically between $21 and $29 per month for a healthy 20 to year-old. Premium: This is the payments that the policyholder makes to the insurer, which can be monthly, semiannually, or yearly. Cash value: Whole life policies have a. Whole life insurance – the premium remains the same for life, the death When deciding what life insurance is right for you, again, be sure to read. Essentially, a $1m policy produces an effective income for your family of between $65, and $75, over 10 years, assuming your wife leaves. A good amount of life insurance is an amount that will provide a death benefit that can protect your family from financial struggle, as well as one that you can. The average annual term life insurance premium for a year-old preferred applicant in good health is between $ and $ per year. The policy you purchase should have a death benefit of at least this amount, if you can afford it. With term life insurance, you can typically choose a coverage.

Limit alcohol use: Heavy drinkers have a higher risk of health complications and will often pay more for their coverage. Adopt a healthy lifestyle: The state of. The 10x rule simply means you take your annual salary and multiply it by 10 to determine how much life insurance you need. You make monthly or annual payments in return for a payout (death benefit) from the insurer to your beneficiaries if you die when the contract is in place. A. As a new employee, you are able to elect $5, or $10, of term life insurance coverage for your dependent children, (up to age 26). Proof of good health is. If you have a professional designation you may be able to get better rates. Spouse and I have term coverage to 75, $m for one of us, $1m for. The saying used to be that the amount of life insurance you choose to be insured for should be 10 times your income. A good amount of life insurance is an amount that will provide a death benefit that can protect your family from financial struggle, as well as one that you can. Not everyone needs life insurance. In general, life insurance is a good idea if you have family or others who rely on you financially. To decide the amount. The cost of life insurance can vary based on the product type, your age and other contributing factors. How much life insurance you ultimately end up buying. Our most recent Insurance Barometer Study revealed that people think life insurance costs three times more than it really does. Many people were surprised to. 1 The truth is the average cost of a term life insurance premium is around $ a year. Coverage amount; Length of the term selected; Occupation, and. Average Term Life Insurance Rates ; Male, 55, $, $, $ ; Female, 25, $, $, $ The average cost of life insurance per month is $ How much you'll pay monthly for life insurance can depend on what you're looking for in a plan, so we don'. The amount of life insurance you may need depends on a number of different factors. You'll likely want to consider your current financial obligations. Take a look at your current income, debts, investments, and other financial assets to assess an adequate level of coverage and how much of a premium you can. Choosing the right amount of life insurance can feel complicated. Purchase too much, and you could be stuck with years of higher-than-needed premiums. Term life insurance rates by age ; Female, 50, $ ; Male, 55, $ ; Female, 55, $ ; Male, 60, $ One of the simplest ways to get a rough idea of how much life insurance to buy is to multiply your gross (aka before tax) income by 10 to If you pass away during the term (usually 10, 20 or 30 years), your beneficiaries receive a cash payout. Why is term life a good option? With term life.

Are All Books On Kindle Audio

:max_bytes(150000):strip_icc()/kindleaudiobookssearch-e03a0497feeb4b76a7d915eb344ce35a.jpg)

There is also included Audible narration, which is a way for Kindle Unlimited books to read to you, available for thousands of the titles (you can see all the. cloudLibrary by bibliotheca keeps all your books in sync, meaning wherever If you would like to read cloudLibrary titles on your Kindle Paperwhite. The kindle book does not come with audio. There is an option in the Kindle to read the text for you, although it sounds flat, robotic. Did you know you can listen to audiobooks on a Kindle? Here's a quick and easy tutorial on adding Audible audiobooks to any kind of kindle! E-BOOKS & AUDIOBOOKS (view all providers). Libby icon. Libby · hoopla icon BookFlix lets kids read, watch and listen to books and book videos! This fun. You'll be taken to Amazon's website. If prompted, sign into your Amazon account. Tap Get Library Book. The book will appear in all Kindle apps and devices. There are over 50, Kindle ebook titles that come with audiobook narration. You should not only own the Kindle book, but also its matching Audible audiobook. Can you listen to unlimited books on audible? If you purchase an eBook on Kindle Unlimited that has an Audible companion, you'll have access to the audiobook. Kindle books (including those with narration) that you have purchased on Amazon will automatically appear in your app. There is also included Audible narration, which is a way for Kindle Unlimited books to read to you, available for thousands of the titles (you can see all the. cloudLibrary by bibliotheca keeps all your books in sync, meaning wherever If you would like to read cloudLibrary titles on your Kindle Paperwhite. The kindle book does not come with audio. There is an option in the Kindle to read the text for you, although it sounds flat, robotic. Did you know you can listen to audiobooks on a Kindle? Here's a quick and easy tutorial on adding Audible audiobooks to any kind of kindle! E-BOOKS & AUDIOBOOKS (view all providers). Libby icon. Libby · hoopla icon BookFlix lets kids read, watch and listen to books and book videos! This fun. You'll be taken to Amazon's website. If prompted, sign into your Amazon account. Tap Get Library Book. The book will appear in all Kindle apps and devices. There are over 50, Kindle ebook titles that come with audiobook narration. You should not only own the Kindle book, but also its matching Audible audiobook. Can you listen to unlimited books on audible? If you purchase an eBook on Kindle Unlimited that has an Audible companion, you'll have access to the audiobook. Kindle books (including those with narration) that you have purchased on Amazon will automatically appear in your app.

Not all books have audio versions. In the Kindle store, you can identify those that do by checking the search filter "eBooks with Audible Narration." Then on. However, I have not been able to get the Jabberwocky sample that is included with the kindlegen download to work. The book opens ok and shows the audio icon. Amazon books can synchronize with Audible audiobooks on Kindle ebook readers. Which Amazon Kindle Is Right for You? all of the available Kindle models. Except Audible. Audible doesn't allow their authors to change the pricing. for their books, so they are not participating. Because this is not affiliated with. Online shopping for Books with Narration in Kindle Unlimited from a great selection at Kindle Store Store. We celebrate and value all the glories of the human spectrum, in the same way that we celebrate the art of voice, unique perspectives, and storytelling. We. Free audiobooks, ebooks, and magazines from your local library! Borrow bestsellers and read anytime, anywhere. All over the world, local libraries offer. When compared with Audible Premium Plus, however, you're losing the ability to earn credits to own audiobooks; you don't own any of the content you listen to on. All rights reserved. Listen to Audiobooks on Kindle (1st. Generation). •. Purchase Compatible Audiobook Formats. •. Download and Transfer Audiobooks. •. Listen. Listening to Kindle books is a convenient way to enjoy your favorite literature, whether you're on the go or simply prefer auditory learning. Not all ebooks have a whispersync compatible audible book. Even if the books are the same content (same title/author ), that does not mean they are. You'll be taken to Amazon's website. If prompted, sign into your Amazon account. Tap Get Library Book. The book will appear in all Kindle apps and devices. There is also included Audible narration, which is a way for Kindle Unlimited books to read to you, available for thousands of the titles (you can see all the. Try to make sure you've downloaded a book that has a matching Audible audiobook. Books that have a matching audiobook will feature a headphones icon. Want to listen to Audiobook on your Kindle Device? Here we will show you two easy steps to get it work. All you need to do is convert the Audiobooks to mp3. Technician's Assistant: Have you already purchased any audiobooks or subscribed to any audiobook services? Technician's Assistant: Is there anything else the. Kindle will read many of the books aloud simply by pressing a button on the Kindle. You can also listen to audible books by visiting the audio bookstore by. M posts. Discover videos related to How to Listen to Audio Books on Kindle on TikTok. See more videos about Palmistry Moja Love Phone Number. The filter option you are looking for is not available on Kindle App. Unfortunately, we don't have any information about the future availability of the filter. Yet, while a million books sounds impressive, not all of them have an audio version. About 20, Kindle Unlimited ebooks come as audiobooks as well. The.

Is Now A Good Time To Consolidate Debt

Consolidating your credit card debt can simplify your financial life and may help save you money. Whether you seek credit counseling, roll your card debt. Many people are surprised to learn that consolidating credit cards and other personal debt into a new loan can significantly lower their monthly payment, reduce. “Debt consolidation may be a better choice if the total debt amount is manageable and you have a high credit score,” says Matthews. “Debt settlement could be a. If you're overwhelmed by multiple high-interest debts, consolidating could save you money on interest and help you get out of debt faster. We found the best. But consolidating debt isn't always the best option. While consolidation does offer relief by putting your bills into one monthly payment, you might not qualify. A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan. The emotional weight of debt can be overwhelming, but debt consolidation may be able to reduce the burden and even save you money—if it's right for you. With Personal Loan rates as low as % APRFootnote 1, now may be a great time to take care of your finances. Get started by checking your rates. It'd be worth consolidating credit card debt if the interest rate is lower, but makes no sense to include the 0% interest debt in there. Consolidating your credit card debt can simplify your financial life and may help save you money. Whether you seek credit counseling, roll your card debt. Many people are surprised to learn that consolidating credit cards and other personal debt into a new loan can significantly lower their monthly payment, reduce. “Debt consolidation may be a better choice if the total debt amount is manageable and you have a high credit score,” says Matthews. “Debt settlement could be a. If you're overwhelmed by multiple high-interest debts, consolidating could save you money on interest and help you get out of debt faster. We found the best. But consolidating debt isn't always the best option. While consolidation does offer relief by putting your bills into one monthly payment, you might not qualify. A Direct Consolidation Loan allows you to consolidate (combine) one or more federal education loans into a new Direct Consolidation Loan. The emotional weight of debt can be overwhelming, but debt consolidation may be able to reduce the burden and even save you money—if it's right for you. With Personal Loan rates as low as % APRFootnote 1, now may be a great time to take care of your finances. Get started by checking your rates. It'd be worth consolidating credit card debt if the interest rate is lower, but makes no sense to include the 0% interest debt in there.

Upon approval, you combine all those debts into a single new loan. This can save you time and money by lowering the interest rate and monthly payments. By. A personal loan is a good way to consolidate debt if you have a good credit score, or higher. The lower your credit score, the harder it is to get a loan. Consolidating your debt can eventually improve your credit score by reducing credit card debt, making consistent payments on time, and reducing the overall. If the interest rate of your loan or balance transfer card is significantly lower than what you're paying now, then consolidating credit cards into a single. One major draw to consolidating your debt is the potential to receive a lower interest rate, which can save you hundreds or even thousands of dollars in the. Having fewer monthly payments: Many people feel a sense of relief that they no longer need to juggle multiple loan payments and due dates all at once. Instead. When you consolidate, all those separate payments go from many to one. Finally, by paying off those smaller debts and paying your consolidation loan on time. When consolidating debt, it's good to know how it affects your credit. At What Are the Different kinds of Debt? Reading Time: 6 minutes. A man is. If you're worried if your next paycheck will cover the minimum payment on the next round of bills, you're not alone. The good news is that it is possible to get. If you find yourself facing accumulated debt from various lenders, debt consolidation could make managing those bills a lot simpler. Consolidation may not be the right choice for all borrowers. Your loan types, interest rates, and how long you've been making payments can all affect whether. Debt consolidation is the act of taking out a single loan or credit card to pay off multiple debts. · The benefits of debt consolidation include a potentially. Explore Bankrate's expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your debts more. Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts. So, if you truly want to be debt-free, consolidation is a great opportunity to achieve this. Visions has debt experts who can walk you through all the options. You could save up to $3, by consolidating $10, of debt · Quick funding · Bad credit · Borrowing experience · Excellent credit · Competitive rates · Good credit. If you have good credit and a limited amount of debt, you probably won't need to close your existing accounts. You can use a balance transfer or even a debt. For many, it's a practical solution that saves time, money and headaches. Debt consolidation is especially a no-brainer for individuals plagued by high interest. Debt consolidation loans are best used when you have long or open-ended term debt with high interest rates due to the nature of how they are structured. When considering consolidating your debt, use common sense. Remember that borrowing money means you have to repay it. If your borrowing is too high, take.

How Does Investing Through Cash App Work

Cash App Investing is a self-directed service; you are solely responsible for orders placed through your account. Cash App Investing does not provide investment. Cash App is an online money transfer app. A Cash App user can deposit money into their account using another bank account. You can access your account on. To buy stock using Cash App Investing: Tap the Investing tab on your Cash App home screen. Tap the search bar and enter a company name or ticker symbol. And on top of all this, Cash App also allows you to invest in stocks and Bitcoin, giving you a step-by-step introduction to the world of investing. What are. In other words, the Cash App Investing account holds the stocks or ETFs that you purchase, but it does not hold the funds you receive when you sell your shares. But with compound returns, money can grow on itself. It's a long-term investing principle foundational to how Acorns can work for you. THE UP-AND-COMERS. I haven't lost any money. Each stock I invest $ into grows each week, I invest in new stock each time to lower my chances of losing money. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Buy and sell stock with Cash App Investing. Related. What is Investing? Opening an Investing Account · Stock Market Hours · Buying Stock · Selling Stock. Cash App Investing is a self-directed service; you are solely responsible for orders placed through your account. Cash App Investing does not provide investment. Cash App is an online money transfer app. A Cash App user can deposit money into their account using another bank account. You can access your account on. To buy stock using Cash App Investing: Tap the Investing tab on your Cash App home screen. Tap the search bar and enter a company name or ticker symbol. And on top of all this, Cash App also allows you to invest in stocks and Bitcoin, giving you a step-by-step introduction to the world of investing. What are. In other words, the Cash App Investing account holds the stocks or ETFs that you purchase, but it does not hold the funds you receive when you sell your shares. But with compound returns, money can grow on itself. It's a long-term investing principle foundational to how Acorns can work for you. THE UP-AND-COMERS. I haven't lost any money. Each stock I invest $ into grows each week, I invest in new stock each time to lower my chances of losing money. Cash App is the easy way to send, spend, save, and invest* your money. Download Cash App and create an account in minutes. SEND AND RECEIVE MONEY INSTANTLY. Buy and sell stock with Cash App Investing. Related. What is Investing? Opening an Investing Account · Stock Market Hours · Buying Stock · Selling Stock.

While you used to need an account with a brokerage firm to buy and sell shares of stock, mobile payment giant Cash App lets users do so via its app. If you've. After you enable Investing Round Ups, each time you use your Cash App CardCash card we will automatically round up to the nearest dollar and invest the spare. Stock round-ups are wonderful. They are the best thing in the world. It allows you to grow your money. Join over 5 million people securely sending and receiving money with Chipper Cash. Great app to send and receive money across a number of countries. Cash App Investing accounts are self-directed individual brokerage accounts. All other account types, including trading on margin, are not supported at this. Cash App Stocks makes buying stocks easy, whether you're new to the stock market or already have a portfolio. Invest as much or as little as you want. Track your payments and recent transactions in your transaction history, and check your Cash App balance for changes. Receiving payments from others is instant. Cash App Investing allows you to purchase securities in dollar amounts rather than share quantities, allowing you to receive fractional shares. WHAT IS INVESTMENT FRAUD? Investment fraud happens when people try to trick you into investing money. They might want you to invest money in stocks, bonds. This app is super easy for new investors or anyone who doesn't have a lot of money to invest. I did get really excited about how I was finally able to build up. Cash App is the #1 finance app in the App Store. Pay anyone instantly. Save when you spend. Bank like you want to. Buy stocks or bitcoin with as little as. Once the account sponsor approves the sponsored person's request to invest in stocks and bitcoin, the sponsored person can start buying stocks in Cash App. More recently, Cash App introduced an investing feature called Investing that allows users to trade stocks and ETFs commission-free within the application. In. When you open and fund a J.P. Morgan Self-Directed Investing account (retirement or general) with qualifying new money by 10/11/ Cash App, owned by Block Inc. (NYSE: SQ), is one place you can go to buy stocks and save up for retirement. The app lets you invest in stocks, but. In fact, with Cash App, you can invest in your favorite companies with as much or as little money as you want—even as little as $1. To buy fractional shares. Cash App Investing is required to collect this information in order to verify your identity and comply with applicable regulations. Cash App Investing accounts. Access your money penalty-free. You can connect the Cash Plus Account to payment apps like PayPal or Venmo using the account's unique routing and account number. Yes, Cash App stocks legit. If you want to invest in stocks and Cryptocurrency then you can create a account in Cash App and you can can easily. Go to your Invest tab and select Stocks · Select any of your stock investments and tap Sell · Enter an amount and tap Next · Reconfirm the transaction.