761624.ru Market

Market

Meaning Of Blue Chip Stocks

Blue chip stocks are the shares of companies that are reputable, financially stable and long-established within their sector. Some people think blue-chip stocks are boring because they are low-risk investments, but what they don't know is that these stocks got their name from the blue. A blue chip is capital stock of a stock corporation with a national reputation for quality, reliability, and the ability to operate profitably in both good. Stocks of leading and nationally known companies that offer a record of continuous dividend payments and other strong investment qualities. The term 'blue chip stock' refers to any stock of a solid, well-established company. The classic definition of a blue chip is a company with an excellent. A blue chip is a high-quality, relatively low-risk investment; it usually refers to stocks of large, well-established companies that have performed well over a. Blue chip stocks are the shares of public companies that have a proven history of steady growth and staying power. There aren't precise criteria that define. BLUE-CHIP meaning: 1. A blue-chip company or investment is one that blue-chip stocks/shares. (Definition of blue-chip from the Cambridge Business. Blue-chip stocks tend to be household names in the investing community, and by definition have stellar reputations and consistently strong financial results. Blue chip stocks are the shares of companies that are reputable, financially stable and long-established within their sector. Some people think blue-chip stocks are boring because they are low-risk investments, but what they don't know is that these stocks got their name from the blue. A blue chip is capital stock of a stock corporation with a national reputation for quality, reliability, and the ability to operate profitably in both good. Stocks of leading and nationally known companies that offer a record of continuous dividend payments and other strong investment qualities. The term 'blue chip stock' refers to any stock of a solid, well-established company. The classic definition of a blue chip is a company with an excellent. A blue chip is a high-quality, relatively low-risk investment; it usually refers to stocks of large, well-established companies that have performed well over a. Blue chip stocks are the shares of public companies that have a proven history of steady growth and staying power. There aren't precise criteria that define. BLUE-CHIP meaning: 1. A blue-chip company or investment is one that blue-chip stocks/shares. (Definition of blue-chip from the Cambridge Business. Blue-chip stocks tend to be household names in the investing community, and by definition have stellar reputations and consistently strong financial results.

Blue chip means stocks with high price per share (Berkshire A for example). The meaning comes from casinos, where blue chips were worth more per. Blue chip stocks are considered stable, low-risk investments. They are the largest companies trading in the stock market. Blue chip stocks are shares of well-known, established, and financially strong companies recognised for their consistent performance. These companies lead their. Significance for Investing & Finance The concept of blue chip stocks holds significant importance in accounting and finance for several reasons: Investment. Blue-chip stocks are the publicly traded equity securities of large-cap companies with an established, highly regarded industry reputation. Blue-chip stocks are shares of very large and well-recognized companies with sound financial history. Since they have a strong reputation and. Blue-chip companies are stable, well-established businesses that are often worth tens or hundreds of billions of dollars. Their stocks tend to be popular with. Blue chip stocks and shares are an investment which are considered fairly safe to invest in while also being profitable. [business]. Blue chip issues were. For individual investors seeking quality and stability in equities, blue-chip stocks are a popular solution. Blue chips have a mythological status for. Blue Chip stocks are the stock market's foundation. They are shares in companies that are well-established, financially solid, and respected. A blue chip is a stock of a well-established corporation with a reputation for reliability, quality, and financial stability. Blue chip stocks are usually the. Blue-chip stocks are the shares of companies that are well-known and highly respected by both customers and business analysts alike. Blue-chip stocks are. Globally, blue chip companies include The Coca-Cola Company, IBM, and Disney. Risk-averse investors may look to blue chip stocks as they are, in theory, less. blue chip, stock of a large, long-established, and well-financed company, regarded as a sound investment and usually selling at a high price relative to its. Blue chip stocks work in the same way as any other stock. They provide regular dividend payments and appreciate over time depending on how they perform and. Stocks that are issued by blue-chip companies, i.e. companies with a large market capitalisation, are termed blue-chip stocks. Companies that issue these shares. Blue Chip Stocks are the shares of blue-chip companies – well-established and financially stable firms that have been in business for many years. A term used to describe stocks of high-quality, financially sound corporations. Discover More. Notes. “Blue chip” suggests a safe investment. pertains to a substantial well-established company and enjoys public confidence in its worth and stability; also: a company that offers such stocks. Blue chip stocks are the shares of large, established, financially sound companies that have a strong reputation for stability, profitability, and reliability.

Oil Price Bloomberg

WisdomTree Bloomberg Brent Crude Oil(USD) (BRND) ; Change: $ (%) ; Open · $ ; Trade high · n/a ; Year high · $ ; Market Listing · London. Oil. It reflects the return of underlying commodity futures price movements only and is quoted in USD. Methodology: 761624.ru Price, Change, %Change, Contract, Time (EDT). CL1:COM. WTI Crude Oil (Nymex). USD/bbl. , +, +%, Oct , 8/23/ CO1:COM. Brent Crude (ICE). Brent for October settlement was little changed at $ a barrel at p.m. in Singapore. By Yongchang Chin, Bloomberg Get updated commodity futures prices. Find information about commodity prices and trading, and find the latest commodity index comparison charts. Interest Rate, US Treasury, -, -, Futures, ,, 1,, Crude Oil Futures, CL, CL, -, CL, NYMEX, Energy, Crude Oil, North American, Outrights, Futures. The Bloomberg WTI Crude Oil live stock price is What Is the Bloomberg WTI Crude Oil Ticker Symbol? BCOMCL is the ticker symbol of the Bloomberg WTI. One half of Bloomberg's Odd Lots Podcast. One quarter of Light Sweet Crude The price is about $18/bbl lower than the selling price of $95 from 's. The company was founded in and is based in Houston. It acquired Anadarko Petroleum in August Rating. Price Target. WisdomTree Bloomberg Brent Crude Oil(USD) (BRND) ; Change: $ (%) ; Open · $ ; Trade high · n/a ; Year high · $ ; Market Listing · London. Oil. It reflects the return of underlying commodity futures price movements only and is quoted in USD. Methodology: 761624.ru Price, Change, %Change, Contract, Time (EDT). CL1:COM. WTI Crude Oil (Nymex). USD/bbl. , +, +%, Oct , 8/23/ CO1:COM. Brent Crude (ICE). Brent for October settlement was little changed at $ a barrel at p.m. in Singapore. By Yongchang Chin, Bloomberg Get updated commodity futures prices. Find information about commodity prices and trading, and find the latest commodity index comparison charts. Interest Rate, US Treasury, -, -, Futures, ,, 1,, Crude Oil Futures, CL, CL, -, CL, NYMEX, Energy, Crude Oil, North American, Outrights, Futures. The Bloomberg WTI Crude Oil live stock price is What Is the Bloomberg WTI Crude Oil Ticker Symbol? BCOMCL is the ticker symbol of the Bloomberg WTI. One half of Bloomberg's Odd Lots Podcast. One quarter of Light Sweet Crude The price is about $18/bbl lower than the selling price of $95 from 's. The company was founded in and is based in Houston. It acquired Anadarko Petroleum in August Rating. Price Target.

August 2, — Energy prices gained % in July, led by crude oil (+%). Non-energy prices decreased by %. Food prices eased by %. Opinion After oil's big run, it might soon be time to bet on a decline in prices. Jan. 19, at p.m. ET by Thomas H. Kee Jr. Index performance for Bloomberg Brent Crude Oil Multi-Tenor ER Index (BCOMTER) including value, chart, profile & other market data. Get updated data about energy and oil prices. Find natural gas, emissions, and crude oil price changes. Holdings ; --, --, NET OTHER ASSETS / CASH ; %, --, WTI CRUDE FUTURE NOV24 ; %, --, WTI CRUDE FUTURE DEC24 ; %, --, WTI CRUDE FUTURE JUN Stay on top of your portfolio with real-time data, historical charts and the latest news on the oil and gas industry on BNN Bloomberg. Oil futures declined Wednesday, as a downward revision to U.S. employment growth fed prospects for a slowdown in oil demand, pulling prices to their lowest. crude oil. It reflects the return of underlying commodity futures price movements only and is quoted in USD. Methodology: 761624.ru Oil futures declined Wednesday, as a downward revision to U.S. employment growth fed prospects for a slowdown in oil demand, pulling prices to their lowest. Natalie Behring/Bloomberg/Getty Images · 'The time has come': The Fed just Price Change % Change Volume week range. CL WTI Crude Oil. + Bloomberg WTI Crude Oil Historical Data ; Highest: ; Change %. ; Average: ; Difference: ; Lowest: BREAKING: WTI crude oil futures trade at negative price for first time 761624.ru Recent Commodities News · Oil prices edge lower after Monday surge as investors weigh demand outlook · 'I fear a storm is coming': I'm nervous about November's. Get GAS OIL APR8 (LGOc1) real-time stock quotes, news, price and financial information from Reuters to inform your trading and investments. The world's most important oil price is working better than ever after years of criticism 761624.ru The WisdomTree Bloomberg Brent Crude Oil seeks to track the Bloomberg Brent Crude index. The Bloomberg Brent Crude index tracks the price of futures. Brent for October settlement was little changed at $ a barrel at p.m. in Singapore. By Yongchang Chin, Bloomberg crude oil. It reflects the return of underlying commodity futures price movements only and is quoted in USD. Methodology: 761624.ru Bloomberg's commodity overview: . Prices and inventory data available for commodities in the following sectors: Oil (Oil), Natural Gas. OIL INVENTORY REPORTS. Cheaper oil prices affect natural gas, which is positioned as a viable energy alternative to crude oil. WORLD EVENTS. War, financial.

1 To 500 Leverage

leverage, for example, means that for a starting capital amount of $, you could buy as much as $, worth of currencies. The starting capital. CySEC also allows brokers to offer up to margin levels for professional traders. Margin required and leverage. The higher the leverage, the less margin . When using leverage, the cost of each trade will be multiplied by This includes spreads, commissions, and other fees. Therefore. For example, a leverage ratio of means that for every dollar of capital, traders can control $ worth of trading positions. Traders earn by taking. For example, a leverage ratio of means that for every dollar of capital, traders can control $ worth of trading positions. Traders earn by taking. For example, if your account has a leverage of , that means you can trade a position of $50, with only $ Please note that increased leverage. Regulated forex brokers offering 1 to leverage. With leverage you can open trading positions with a total value times your account equity. Choose the increased leverage when registering a new MT4/MT5 account or opening your first account. New trading opportunities. Operations on MetaTrader 4/5. leverage, for example, means that for a starting capital amount of $, you could buy as much as $, worth of currencies. leverage, for example, means that for a starting capital amount of $, you could buy as much as $, worth of currencies. The starting capital. CySEC also allows brokers to offer up to margin levels for professional traders. Margin required and leverage. The higher the leverage, the less margin . When using leverage, the cost of each trade will be multiplied by This includes spreads, commissions, and other fees. Therefore. For example, a leverage ratio of means that for every dollar of capital, traders can control $ worth of trading positions. Traders earn by taking. For example, a leverage ratio of means that for every dollar of capital, traders can control $ worth of trading positions. Traders earn by taking. For example, if your account has a leverage of , that means you can trade a position of $50, with only $ Please note that increased leverage. Regulated forex brokers offering 1 to leverage. With leverage you can open trading positions with a total value times your account equity. Choose the increased leverage when registering a new MT4/MT5 account or opening your first account. New trading opportunities. Operations on MetaTrader 4/5. leverage, for example, means that for a starting capital amount of $, you could buy as much as $, worth of currencies.

However, financial regulations in limited the leverage ratio that brokers could offer to U.S.-based traders to (still a rather large amount).5 This. In forex trading, leverage can often be as high as Since currencies move incrementally compared to stocks, using leverage doesn't carry the same risks. Leverage in forex trading means that for every $1 of your capital, you can control a position worth $ in the forex market. With a leverage of and an investment of only $, traders can open positions worth $5, If the trade turns a profit, this profit is not paid by the. Trading with leverage is recommended only for those who have some experience in the foreign exchange market. Novices should be warned that if they try to. What is High Leverage Broker? Forex trading is known for its leveraged trading or finance leverage also known as margin trading since allows traders to use the. With leverage and $1, in your trading account, you can open a position of 5 standard lots and still have $ left for loss toleration. · With For example, a leverage ratio of means that for every dollar in a trader's account, they can trade $ on the forex market. A leverage ratio of 1. Leverage in forex trading means that for every $1 of your capital, you can control a position worth $ in the forex market. Such levels are best for scalping, for instance. Scalpers would typically use leverage ranging from to or even higher in an attempt to extract the. And yes. You will blow your account if you apply leverage into one trade, no matter how much money you have on account. We are going to tell you over here in this blog post. Trading with leverage or is often considered as a highway to hell. We will look at some of the best forex brokers with leverage. We will look at their features to examine what makes them stand out among the rest. leverage refers to the ability to control $ for every $1 in your account. Your Turn. Did you learn something new about Forex leverage? Are you going to. If you are using a leverage of (1% margin) and you are trading with a $2, account, your position size should not exceed $ If you set up a trade. I trade a couple of assets with leverage on LonghornFX. They are always on point with withdrawals. That's why I chose them. Make sure to hedge your trades. Leverage Ratio: Put simply, it is the amount of exposure you are able to gain with respect to the capital invested. It can range from (twice the initial. OspreyFX is a lightning fast ECN forex broker offering up to leverage on Forex, Cryptos, Stocks and Commodities with full STP execution. For example, if your account has a leverage of , that means you can trade a position of $50, with only $1, Please note that increased leverage. Using the initial margin example above, the leverage ratio for the trade would equal ($, / $1,). In other words, for a $1, deposit, an.

Owning An Investment Property

Keep housing expenses low. Ok, let's say you decide to go for it and buy an investment property. You do not own your home yet, so you will have to rent. Steps for Investing in Vacation Rentals · Do Your Homework · Conduct an In-Depth Market Analysis · Understand the Rhythm of Vacation Rentals · Calculate Your. An investment property is a good source of steady income when done correctly. Learn what an investment property is and things to consider before buying. While buying real estate has historically been a solid investment, it's not a guaranteed one. So, when debating whether to finance your first investment. Five Advantages of Owning Investment Properties · You Have More Control · Property Appreciation · Money in Your Pocket · Paying Off Your Mortgage · Tax Benefits. Characteristics of a Great Rental Property · The property exists in a profitable rental market, earning at least 1% of the purchase price in rent per month. Hi folks, My husband and I plan to buy our first investment property and we don't know anything about it. We are trying to buy an investment. Should you buy an investment property? · Key takeaways · Potential risk: Cost of ongoing time and effort · Potential reward: Unique tax advantages · Potential. Absolutely not, It's always more profitable to have the investment property fully paid off. Yes, you will pay more taxes since you will no. Keep housing expenses low. Ok, let's say you decide to go for it and buy an investment property. You do not own your home yet, so you will have to rent. Steps for Investing in Vacation Rentals · Do Your Homework · Conduct an In-Depth Market Analysis · Understand the Rhythm of Vacation Rentals · Calculate Your. An investment property is a good source of steady income when done correctly. Learn what an investment property is and things to consider before buying. While buying real estate has historically been a solid investment, it's not a guaranteed one. So, when debating whether to finance your first investment. Five Advantages of Owning Investment Properties · You Have More Control · Property Appreciation · Money in Your Pocket · Paying Off Your Mortgage · Tax Benefits. Characteristics of a Great Rental Property · The property exists in a profitable rental market, earning at least 1% of the purchase price in rent per month. Hi folks, My husband and I plan to buy our first investment property and we don't know anything about it. We are trying to buy an investment. Should you buy an investment property? · Key takeaways · Potential risk: Cost of ongoing time and effort · Potential reward: Unique tax advantages · Potential. Absolutely not, It's always more profitable to have the investment property fully paid off. Yes, you will pay more taxes since you will no.

Pro: Control over your investment. Finally, people tend to buy investment properties because they have more control over the asset compared to other common. How do I find an investment property? To maximize your investment, you'll want to make sure any rental home you buy is in the right location — one in which. Purchasing an investment property or a second home come with certain risks. Again, they usually require a substantial down payment, which will deplete your. Does a purchase make financial sense? · Investing in rental property should be considered a long-term investment that helps build capital. · Consider whether. It takes sleuthing skills to track down the right property in the right neighborhood. Here are some key factors to consider when shopping for an investment. Buying rental properties in Texas involves several key steps. You should begin by assessing your financial situation and saving for a down payment in the region. If you are investing on property that has 5 or more units, this is considered a commercial rental property and would need a commercial loan. Midland States Bank. An investment property is any home that is NOT occupied by the owner. It can, however, also be a second home or vacation home that is too close in proximity to. You can use the funds you get from a HELOAN to finance the purchase of an investment property. Alternatively, if you already own an investment property, you can. You can own an investment property with a relatively small amount of out-of-pocket money. For example, if you wanted to buy $, of stock, you would need. The Pros and Cons of Buying an Investment Property While Still Renting · Homeowner Grants/Tax Credits · Avoid the Pitfalls of Renting · Owning Your Home. Buying An Investment Property · FHA & VA loan programs are ineligible for the purchase of an Investment Property. · The minimum down payment for the purchase of. How to invest in a rental property · 1. Secure your financing · 2. Choose what you want to buy and where · 3. Choose your strategy · 4. Research and analyze · 5. While there's technically no "limit" to the amount of investment real estate you can own, there are several important things you'll want to consider before. Costs to own an investment property · council and water rates · building insurance · landlord insurance · body corporate fees · land tax · property management fees . Have money for a large down payment—you will need at least 15% to put down to obtain traditional financing on such a property, and mortgage insurance does not. The lived-in investment property isn't such a big gain because there are typically greater live in costs, but profit is still quite possible. Further, the owner. Top Tips for Real Estate Investments in Maryland · 1. Determine Your Price Range · 2. Opt for Areas that Offer the Highest Return on Investment · 3. Invest in. How To Buy Rental Property · Step 1: Research · Step 2: Determine your location and market · Step 3: Figure out the money · Step 4: Analyze deals · Step 5: find. For property investors, there are three key areas of potential: capital growth, rental income and tax benefits. When thinking about your investment strategy.

Best Way To See Credit Score

Federal law gives you the right to get a free copy of your credit report every 12 months from each of the three nationwide credit bureaus. In addition, the. They are Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so the information in each of your reports may be slightly. 1. Use a credit score service or scoring site · 2. Request your scores from the three major credit bureaus · 3. Check with your bank · 4. Check with your credit. You can get one free copy of your credit report every 12 months from each of the three major credit reporting companies (Equifax, Experian, and TransUnion). All. To stay up to date, request a free report from one of these agencies every four months on a rotating basis and check your report for accuracy. Just go to. Every year, you're entitled to one free credit report from each of the main credit bureaus — Experian, Equifax and TransUnion. You can access these reports for. You can check your credit score in less than five minutes by logging into your credit card issuer's site or a free credit score service and navigating to the. How to find your true FICO Score® · Step 1 – Check with your bank or credit union. The first step you can take towards finding your FICO Score is by checking. On Credit Karma, you can get your free credit scores from Equifax and TransUnion. No credit card required — ever. Learn how to check and monitor your scores. Federal law gives you the right to get a free copy of your credit report every 12 months from each of the three nationwide credit bureaus. In addition, the. They are Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so the information in each of your reports may be slightly. 1. Use a credit score service or scoring site · 2. Request your scores from the three major credit bureaus · 3. Check with your bank · 4. Check with your credit. You can get one free copy of your credit report every 12 months from each of the three major credit reporting companies (Equifax, Experian, and TransUnion). All. To stay up to date, request a free report from one of these agencies every four months on a rotating basis and check your report for accuracy. Just go to. Every year, you're entitled to one free credit report from each of the main credit bureaus — Experian, Equifax and TransUnion. You can access these reports for. You can check your credit score in less than five minutes by logging into your credit card issuer's site or a free credit score service and navigating to the. How to find your true FICO Score® · Step 1 – Check with your bank or credit union. The first step you can take towards finding your FICO Score is by checking. On Credit Karma, you can get your free credit scores from Equifax and TransUnion. No credit card required — ever. Learn how to check and monitor your scores.

When it comes to the best way to check credit score, the Consumer Financial Protection Bureau (CFPB), a U.S. government agency, indicates there are several ways. If you want even more insight into your credit, check out ExtraCredit®. For $ a month, you can see 28 of your FICO® Scores from all three major credit. Many credit card companies offer free credit scores to their customers, either on their monthly statements or online. Check with your credit card issuer to see. Best Overall: 761624.ru · Best for Credit Monitoring: Credit Karma · Best for Single Bureau Access: Credit Sesame · Easiest Sign-Up: NerdWallet · Best. You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to 761624.ru to check your report. FICO® Credit Score and credit report plus score ingredients and tips. Score of Enroll to get the full picture of your FICO® Score. Follow these. While you won't see your score, it is important to check for any mistakes or possible fraud. If a bill is sent to collections, it stays on your report for 7. You can request annual credit reports for free from each of the 3 major reporting agencies—Experian, Equifax® and TransUnion®—online via 761624.rucreditreport. Many financial services companies like Credit Karma and NerdWallet also offer a free credit score check. These services can provide a good estimate of your. Check your credit report. Get a free credit report from each of the three credit reporting agencies (Equifax, Experian and TransUnion) once a year at. The best scores go to people using 10% or less of their credit limits. Keep accounts open and active when possible — that gives you a longer payment history and. If you know your history is good, your score will be good. You can get your credit report for free. It costs money to find out your credit score. Sometimes a. They are Equifax®, Experian® and TransUnion®. Each credit bureau compiles its own credit reports, so the information in each of your reports may be slightly. While scores differ between credit agencies – and financial product providers use their own scoring system – you can get a good steer by using. You'll get a free monthly Equifax credit report and free monthly VantageScore credit score based on Equifax data. A VantageScore is one of many types of credit. WalletHub is the best place to get free credit scores because the scores update daily, which means you'll always see the latest information. If your credit. You can request a free copy of your credit report from all three credit bureaus once a year at 761624.ru, opens in new tab. If you find any errors. Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close unused. Check your credit card, financial institution or loan statement. · Create a myEquifax account and click “Get my free credit score” to enroll in Equifax Core. When it comes to the best way to check credit score, the Consumer Financial Protection Bureau (CFPB), a U.S. government agency, indicates there are several ways.

How To Verify My Credit Score

Get quick access to your credit report and credit score online at TransUnion Canada. You can also learn how to request a free credit report. Consumers are now entitled to receive free weekly credit reports from each of the three major credit reporting bureaus (Equifax, Experian, and TransUnion). Sign in to Online Banking · Scroll down to the box on the right-hand side labelled My Services · In the My Services box, select View Your Credit Score · Review the. NerdWallet explains your score and shows you how you're doing on the factors that influence it most. In the same convenient dashboard, you can see your cash. Go to any of the 3 credit bureaus to check your scores. Also, many credit cards and banks provide your credit score for free. The FICO score is the one that. Start by going to 761624.ru and request your free reports from the three national credit reporting agencies. What Hurts Your Credit Score the Most? To access your free Equifax Canada consumer credit report, disclosure, please visit 761624.ru and click on Get my free credit report. During Equifax. At your request, TransUnion will verify any credit information disputed by you. I corrected things on my credit report and my score went down. Can you. Here's how to check your credit score for free online, by mail, phone or in person with Equifax or TransUnion. Get quick access to your credit report and credit score online at TransUnion Canada. You can also learn how to request a free credit report. Consumers are now entitled to receive free weekly credit reports from each of the three major credit reporting bureaus (Equifax, Experian, and TransUnion). Sign in to Online Banking · Scroll down to the box on the right-hand side labelled My Services · In the My Services box, select View Your Credit Score · Review the. NerdWallet explains your score and shows you how you're doing on the factors that influence it most. In the same convenient dashboard, you can see your cash. Go to any of the 3 credit bureaus to check your scores. Also, many credit cards and banks provide your credit score for free. The FICO score is the one that. Start by going to 761624.ru and request your free reports from the three national credit reporting agencies. What Hurts Your Credit Score the Most? To access your free Equifax Canada consumer credit report, disclosure, please visit 761624.ru and click on Get my free credit report. During Equifax. At your request, TransUnion will verify any credit information disputed by you. I corrected things on my credit report and my score went down. Can you. Here's how to check your credit score for free online, by mail, phone or in person with Equifax or TransUnion.

90% of top lenders use FICO Scores. Get credit scores, credit reports, credit monitoring & identity theft monitoring in one place. Whether you're applying. Yes, you can access your free credit report on your CreditView Dashboard. With the mobile app: Choose Help & services from the main menu, and then scroll to. Contact one of three credit reporting agencies. Three national credit reporting agencies do credit checks on individuals. They are Equifax, Experian and. How much does it cost to check my FICO® Score through MyCredit Guide? Just enroll in MyCredit Guide and you can check your FICO® Score and Experian® credit. You have the right to access your credit report free of charge. To do so, you must send your request by mail, and include a copy of two pieces of ID. This can. Get free weekly credit reports from all three credit reporting agencies at 761624.ru You can also get your TransUnion credit report through our. Steps to progress your credit score · Take your credit health into your hands · Know your file · Grow your score · Meet the. Advancers · See us as your score support. Ask the lender to verify its files and provide the credit reporting agencies with updated information. Does my free credit report include my credit score? No. Mobile app users: From the main menu select Help & services. Choose View credit score from the list. If you don't see it, choose Show all in the upper right. Your PII is not used to calculate your FICO Scores. Updates to this information come from information you supply to lenders when you apply for new credit. What. You can now check your credit score as often as you want, at no additional cost and zero impact to your score using the TransUnion Credit Score tool. Learn how to check your score without impacting your credit rating. A Convenient & Secure Way to See Where Your Credit Stands. As an RBC Online Banking client. Borrowell is free and there is a mobile app for credit score checks. I also cross-reference this with my various banks. Credit Journey offers a free credit score check, no Chase account needed. Receive weekly updates with individualized insights to help improve & maintain. WalletHub is the best place to get free credit scores because the scores update daily, which means you'll always see the latest information. If your credit. The good news is that you may be able to get your score for free from a bank or credit card issuer Here's how to check your credit score. Key Takeaways. Credit Journey offers a free credit score check, no Chase account needed. Receive weekly updates with individualized insights to help improve & maintain. On your Accounts Screen under Loans and Credit, tap View your FICO® Score. Step 3. You'll see your score displayed. Verify your identity and check on your credit score with a free app. Now, with Interac® verification service 1, you can securely prove who you are quickly and. 1. Visit Credit Karma for free weekly scores. Credit Karma is one of the most popular free credit score services out there.

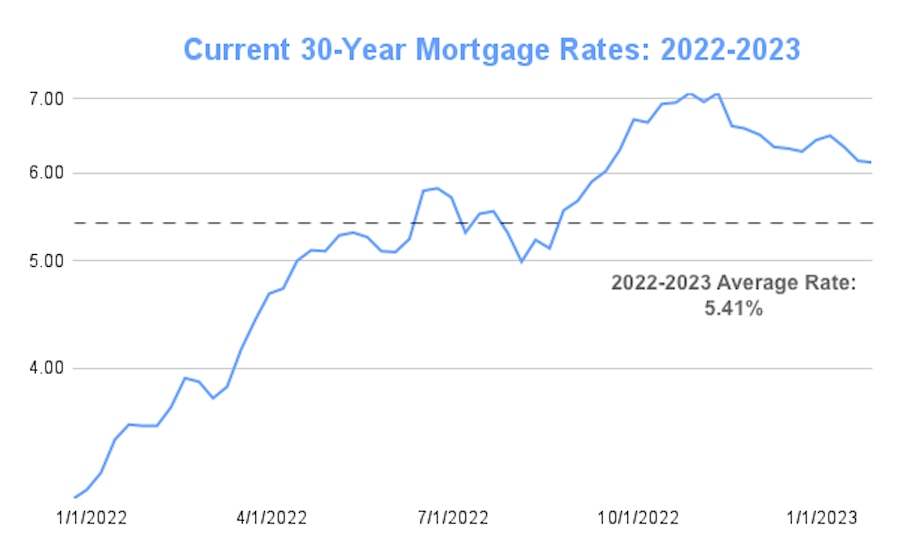

30 Year Mortgage Rates First Time Home Buyer

The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January Note: Interest rate= (i.) First mortgage rate in effect -OR- (ii.) % (% %); whichever is less. Up to a $ Application Fee payable to the Lender. For today, Tuesday, September 03, , the current average year fixed mortgage interest rate is %, down 7 basis points compared to this time last week. Among the various mortgage options available, the year fixed mortgage rate is one of the most popular choices for homeowners. What is a Year Fixed. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Mortgage Interest Rates ; With % OHFA Assistance · With 5% OHFA Assistance · Conventional Year Fixed Rate Loans ; % · % · Conventional Year Fixed. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Speak with our Mortgage Loan Officer, today for a fast, local decision. 30 Year Fixed Conventional Mortgage · First Time Homebuyer Program · Adjustable Rate. Compare today's year fixed mortgage rates from top mortgage lenders. Find out if a year fixed-rate mortgage is the right type of home loan for you. The best year mortgage rates are usually lower than 4%, and the average mortgage rate nationally on a year fixed mortgage is % as of January Note: Interest rate= (i.) First mortgage rate in effect -OR- (ii.) % (% %); whichever is less. Up to a $ Application Fee payable to the Lender. For today, Tuesday, September 03, , the current average year fixed mortgage interest rate is %, down 7 basis points compared to this time last week. Among the various mortgage options available, the year fixed mortgage rate is one of the most popular choices for homeowners. What is a Year Fixed. Mortgage rates fell again this week due to expectations of a Fed rate cut. Rates are expected to continue their decline and while potential homebuyers are. Mortgage Interest Rates ; With % OHFA Assistance · With 5% OHFA Assistance · Conventional Year Fixed Rate Loans ; % · % · Conventional Year Fixed. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. Speak with our Mortgage Loan Officer, today for a fast, local decision. 30 Year Fixed Conventional Mortgage · First Time Homebuyer Program · Adjustable Rate. Compare today's year fixed mortgage rates from top mortgage lenders. Find out if a year fixed-rate mortgage is the right type of home loan for you.

30 Year Fixed $1, 15 Year Fixed $1, 5y/6m ARM Variable $1, About ARM rates. Mortgage rates valid as of a.m. Pacific Daylight Time. In a year fixed mortgage, your interest rate stays the same over the year period, assuming you continue to own the home during this period. These. Year FixedYear FixedAdjustable-Rate MortgageBorrowSmart We have two that show you what mortgage interest rates mean for you as a home buyer. Federal Housing Administration (FHA) mortgages are low down payment, fixed-rate home loans with credit score requirements lower than those of conventional. Today's year mortgage rates can be customized from major lenders. NerdWallet's 30 yr mortgage rates are based on a daily survey of national lenders. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday. Today's Special Mortgage Rates ; 3 Year Fixed · Amortization · %. % ; 5 Year Smart Fixed · Default insured mortgage · %. % ; 5 Year Smart Fixed. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. first-time home buyer purchase their first home in Canada with a longer amortization period. Starting August 1, , lenders will be offering year. Sample Annual Percentage Rates (APRs): CalHFA First Mortgage Loans ; 30 yr ( months), 30 yr ( months), 30 yr ( months) ; $2,, $2,, $2, Today's rate. $3, year fixed first-time homebuyer. See detailed quote Year Fixed Mortgage (New Purchase). Today's rate. as low as%. ( 30 year fixed, , with a credit score. $ origination fees. New home purchase ; year fixed mortgage · % · % ; year fixed mortgage · % · %. One benefit of the current situation is that buyers are enjoying balanced market conditions, with July's national sales-to-new-listings ratio (SNLR) standing at. year FHA loans: % with point (previous week: % with point). Mortgage Rate Trends, Past 3 Months. YR Fixed, Most home buyers can get a year fixed home loan with a down payment of just 3% or %. And you don't need a perfect credit score to qualify. Thanks to these. First-time home buyer. Buying your first home is an exciting decision. Check out our home-buying guide for tips on getting started and what to consider. Homebuyer Loan Programs Interest Rates ; Fixed Rate Plus Loan 3%*, %, % ; Fixed Rate Plus Loan 5%*, %, % ; Grants for Grads 5%**, %, SONYMA's FHA Plus Program is a mortgage program that combines year fixed rate mortgages with SONYMA down payment assistance for both first-time homebuyers. year mortgage amortization. Otherwise, a 20% downpayment is not a Lenders' fixed mortgage rates are closely tied to the price of five-year government bonds.

How Much It Cost To Buy Land

On average, what does public land cost per acre? There is no "average" cost The highest qualified bidder is eligible to buy the land; the deposits of. Depending on the number of buildings, subdivision surveys cost $ to $ per lot. The average subdivision lot is just under ⅕ of an acre but can be much. Realtors charge 10% to the seller on land in the UP. Owner probably want's 10K and tacked on the realtor fee. The second cheapest region on our list to buy hunting land is made up of Minnesota and Wisconsin – two states which have left their mark on the Boone and. On average, in the United States, the cost of one acre of land is around $16, You can buy an acre for under $1, in some places, but some commercial lots. Only one of these is the purchase price to acquire ownership rights to a property. Land trusts invest much time in confidential negotiations with willing. How much does it cost to buy land at tax defaulted auctions? Counties usually sell properties at rock bottom prices of 10 cents, 20 cents, or 30 cents on the. You aren't likely to see anything like this price for any kind of lot in the city, but if you buy a large parcel of undeveloped land, your per acre total will. In , an acre of land in Baltimore County, Maryland costs between $50, and $, Keep reading to learn how utilities, permitting and similar. On average, what does public land cost per acre? There is no "average" cost The highest qualified bidder is eligible to buy the land; the deposits of. Depending on the number of buildings, subdivision surveys cost $ to $ per lot. The average subdivision lot is just under ⅕ of an acre but can be much. Realtors charge 10% to the seller on land in the UP. Owner probably want's 10K and tacked on the realtor fee. The second cheapest region on our list to buy hunting land is made up of Minnesota and Wisconsin – two states which have left their mark on the Boone and. On average, in the United States, the cost of one acre of land is around $16, You can buy an acre for under $1, in some places, but some commercial lots. Only one of these is the purchase price to acquire ownership rights to a property. Land trusts invest much time in confidential negotiations with willing. How much does it cost to buy land at tax defaulted auctions? Counties usually sell properties at rock bottom prices of 10 cents, 20 cents, or 30 cents on the. You aren't likely to see anything like this price for any kind of lot in the city, but if you buy a large parcel of undeveloped land, your per acre total will. In , an acre of land in Baltimore County, Maryland costs between $50, and $, Keep reading to learn how utilities, permitting and similar.

Unlock the best deals: Find out how much 1 acre of land in Montana costs Buy Land in Montana: An Overview. Buy Land in Montana. About Montana. Montana is. Discover if buying land and building in the UK is cost-effective. Expert insights on the economics of land purchase and home construction. Determine how much your land loan in Texas will cost. Making the decision to buy land in Texas is exciting. Whether you plan to use the acres to launch an. Buying the plot of land. The average cost of purchasing land for home building is $76, In rural areas, unfinished plots have an average cost of $3, per. Dude that's wayyyy too much money for acres of land.. that's like almost $,? That rv isn't worth to you what it is worth to them. In Montana, you can get undeveloped land for a median of $1,/acre. Land in the major cities of the U.S. averages about $, per acre. In. How much does land cost? Much like houses, the price of land in the UK can Purchasing land and tax. When it comes to buying a plot of land, it's. Only one of these is the purchase price to acquire ownership rights to a property. Land trusts invest much time in confidential negotiations with willing. Buy Open Buy sub-menu. San Francisco homes for sale. Homes for sale See how much you qualify for · Estimate your monthly payment. Just getting. For example, the two states with the lowest farm cost per acre have the lowest overall cost. How Much An Acre Of Land Costs In Each State - ZIPPIA · Land. The average cost per acre of land in California is between $5, and $12, But there's more, this figure doesn't paint a true picture of the 761624.rurnia. For example, the two states with the lowest farm cost per acre have the lowest overall cost. How Much An Acre Of Land Costs In Each State - ZIPPIA · Land. People purchase land for many reasons. Land can be used for residential The data includes the price of land with existing homes and the cost of land. The average price of farms, ranches and other land parcels for sale in Florida is $, U.S. Department of Agriculture data shows. Here in Illinois it averages out at just under $30, per acre. So if you already own land in a state with high land prices it will almost certainly be cheaper. The average price of land listings for sale in Ohio is $, Ohio's agricultural economy is diverse, with top products including. House and Land prices and construction costs in Bali. How much does it cost to buy land and build in Indonesia? Prices have been rising rapidly over the past. A land contract costs an average of $ per project for a legally binding contract between a landowner and a buyer who agrees to purchase the land. Unlike. The type of loan you take out, and how easy it is to qualify for, will depend on where you buy land and how you intend to use it. A land loan is more complex. This land development cost will vary based on the size of your lot and How Can I Make Sure the Land I Buy Has Minimal Site Development Requirements?

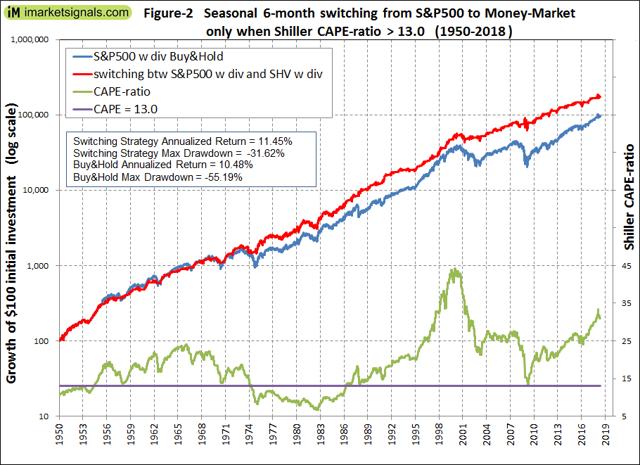

How Much Should I Invest In The S&P 500

The S&P is typically regarded as the benchmark for US equities and has produced average annual returns of about 10%, or a bit more than 7%, adjusted for. S&P Index Explained: What is the S&P , how is it calculated, and what does it include? S&P vs Dow Jones (DJIA): Which index is better? People often use the S&P as a yardstick for investing success. Active With that, you could expect your $10, investment to grow to $34, in 20 years. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives. S&P ® Index (Index). Fund Data. Average Annual Returns (%). 1 Year: + investments, the fund's performance could be impacted. Any fund holdings. Established in , the S&P index has delivered an average annual return of %. If you invested $ in a mutual fund that captured all S&P To invest in S&P ETFs, investors can gain exposure through discount brokers with commission-free trading. S&P index funds trade through brokers and. The market cap of the company must be at least $ billion, and the float-adjusted market capitalization (i.e., the total value of publicly traded shares). The chart below shows two hypothetical investments in the S&P over the year period ending December 31, Each investor contributed $10, every year. The S&P is typically regarded as the benchmark for US equities and has produced average annual returns of about 10%, or a bit more than 7%, adjusted for. S&P Index Explained: What is the S&P , how is it calculated, and what does it include? S&P vs Dow Jones (DJIA): Which index is better? People often use the S&P as a yardstick for investing success. Active With that, you could expect your $10, investment to grow to $34, in 20 years. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor's particular investment objectives. S&P ® Index (Index). Fund Data. Average Annual Returns (%). 1 Year: + investments, the fund's performance could be impacted. Any fund holdings. Established in , the S&P index has delivered an average annual return of %. If you invested $ in a mutual fund that captured all S&P To invest in S&P ETFs, investors can gain exposure through discount brokers with commission-free trading. S&P index funds trade through brokers and. The market cap of the company must be at least $ billion, and the float-adjusted market capitalization (i.e., the total value of publicly traded shares). The chart below shows two hypothetical investments in the S&P over the year period ending December 31, Each investor contributed $10, every year.

Since , the average annual total return for the S&P , an unmanaged index of large U.S. stocks, has been about 10%. Investments that offer the. And by that measure, stocks from other places (i.e. international stocks) are tempting. While US stocks' valuations are above their year average. It's up to you to decide how much of an allocation to stocks might be right for ICMA-RC does not offer specific tax or legal advice and shall not have. The total of all fees to manage or operate an investment fund. 2. Average taxable gain passed on to shareholders when an investment within an ETF or mutual fund. DURING TIMES OF MARKET TURBULENCE, a key piece of advice is often to lean toward stocks of large, high-quality companies. “Major firms with proven earnings. Investors should consider the investment objectives, risks, charges, and expenses of a mutual fund carefully before investing. Download a prospectus, or. To purchase an S&P index fund, you must generally have at least $3, to $5, to invest. In addition, for a fixed index annuity, you must have at least. The portfolio of iShares S&P Index XUS, which follows the S&P , has an average market cap of $ billion. By contrast, Vanguard U.S. Total Market ETF. How to Invest · Virtual Stock Exchange · Video · MarketWatch 25 Years Why the S&P Could Hit by Year End. Aug. 30, at p.m. ET by. This is higher than the long term average of %. The S&P 1 Year Return is the investment return received for a 1 year period, excluding dividends, when. With a % expense ratio, it's the cheapest on our list. And it doesn't have a minimum initial investment requirement, sales loads or trading fees. Over the. Today's chart comes from OneDigital and shows that the average return for years ending in was % for the S&P , while the average investor only. The portfolio of iShares S&P Index XUS, which follows the S&P , has an average market cap of $ billion. By contrast, Vanguard U.S. Total Market ETF. However, there are two methods to invest: buy exchange-traded funds (ETFs) or mutual funds that track the S&P index or buy individual stocks that make up. Why should I care about risk? Price. Minimum Investment. $ as of 08/29/ The market cap of the company must be at least $ billion, and the float-adjusted market capitalization (i.e., the total value of publicly traded shares). Investing in the S&P edit. Mutual and exchange-traded funds. edit · Index "The S&P has already met its average return for a full year, but don. $10, invested in the S&P at the beginning of would have grown to $32, over 20 years — an average return of % per year. Missing the 'top. That's an average of over 16 every year. S&P all-time highs by decade. sp all time highs by decade. Many consider this a 'boring investment,' but the results the index has produced are nothing to balk at. The average yearly return of the S&P over the.

Buying A House Through Credit Union

If you are currently going through the home buying process and shopping for loans, take some time to learn the benefits of choosing a credit union for a home. At Metro Credit Union, we understand that buying a home is a big decision. We've been in the mortgage lending business for more than 40 years. I'm getting a much better rate with my credit union than through my mortgage broker, about % lower. Credit union says they can close in 14 days. Getting pre-approved will let you know how much you can afford. Our mortgage department can also help you estimate your mortgage payment and property taxes. Whether you've got your eye on a particular piece of property or just beginning your search, your credit union is a good place to start. The Online Mortgage. Rebate is 20% for purchase only of a residential property. Payment is credited to your benefit at the close of transaction. Using Orange County's Credit Union. Credit unions offer mortgages that meet almost every typical homebuyer's financing needs, whether you're buying an existing home, purchasing an ideally situated. Here at Credit Union 1, our array of home financing solutions are designed to meet your individual needs, including personalized assistance and competitive. Credit unions generally have lower rates than banks and other types of lenders, making them the better choice for your home mortgage. If you are currently going through the home buying process and shopping for loans, take some time to learn the benefits of choosing a credit union for a home. At Metro Credit Union, we understand that buying a home is a big decision. We've been in the mortgage lending business for more than 40 years. I'm getting a much better rate with my credit union than through my mortgage broker, about % lower. Credit union says they can close in 14 days. Getting pre-approved will let you know how much you can afford. Our mortgage department can also help you estimate your mortgage payment and property taxes. Whether you've got your eye on a particular piece of property or just beginning your search, your credit union is a good place to start. The Online Mortgage. Rebate is 20% for purchase only of a residential property. Payment is credited to your benefit at the close of transaction. Using Orange County's Credit Union. Credit unions offer mortgages that meet almost every typical homebuyer's financing needs, whether you're buying an existing home, purchasing an ideally situated. Here at Credit Union 1, our array of home financing solutions are designed to meet your individual needs, including personalized assistance and competitive. Credit unions generally have lower rates than banks and other types of lenders, making them the better choice for your home mortgage.

One Loan, from construction through final permanent mortgage. FCU offers new construction loans to make your vision for a custom home a reality. FCU can. Using California Coast Credit Union for a mortgage loan is not a requirement to earn the rebate. Purchase price must be greater than $, All rebates are. Suncoast's mortgage solutions offer low rates, low closing costs, and the personalized services you need to easily finance or refinance your home. Truliant will help you find a credit union mortgage loan that works for your budget so you can purchase a home you'll truly love. Learn more! Lenders like credit unions are able to offer more flexible loans and generally better service as they are not for profit organizations. Fixed monthly payments for easy budgeting · Available in a variety of loan term options · Good option if you plan to stay in your home for the long term. Using the same guidelines as most banks and credit unions, we'll help you determine how much house you can really afford. This information takes the anxiety out. We're here to guide you through your home loan purchase or refinance - from getting pre-qualified all the way through closing. Call our Real Estate Loan Center. First-time home buyer loans from Service Credit Union. We help first-time homebuyers secure competitive mortgage rates and expertly guide you through every. Down Payment Options. As low as 3% for a single-family home with a mortgage amount of $30, or more · Closing Costs. Flat closing cost of $ ($ on. Credit unions are able to offer low mortgage rates, much lower than banks, because they borrow against themselves, being responsible to their own depositors. % Financing Loan Rates ; Rates as of Sep 02, ET. ; % · % · Rates as of Sep 02, ET. ; · · Rates as of Sep 02, ET. mortgage loan from Navy Federal Credit Union. (e) Choice loan products The cash back is only available with the purchase or sale of your home through. Louisiana Federal Credit Union understands getting a mortgage and buying a house can feel overwhelming. Our trusted home loan experts will help you get. The benefits of using a credit union for your mortgage include attractive loan terms, unique loan programs, superior customer service and more flexible. When looking for a home loan, the two main choices of financial institutions are credit unions and banks. Each option comes with pros and cons. Mortgage loan officers with co-op experience who can guide you through Purchase” guide for helpful tips about going through the home buying process. Specifically designed for first time homebuyers, Kohler Credit Union is now offering fixed and adjustable mortgage options for those looking to purchase their. USC Credit Union offers affordable fixed-rate and adjustable-rate mortgages, refinance mortgage loans, HELOCs and home equity loans for first-time home. Fixed Rate Mortgages · Your monthly payment will not change · Choose from a variety of loan terms · Available for purchase or refinance · No points/no closing costs.